The Complete List of Auto Insurance Companies: From Allstate to USAA

Car insurance providers you can trust

Get quotes from providers in your area

Finding the right auto insurance provider isn’t just about brand names—it’s about trust, savings, and service. That’s why our list goes beyond the basics.

We independently research, verify, and update this comprehensive guide each month using the latest NAIC market share data, insights from over 3,000 local insurance agents, and thousands of verified user reviews. Our goal: help you compare leading insurance companies quickly and confidently, whether you want the biggest brand, the best value, or specialty options for your needs.

Editor’s Picks: Best Car Insurance Companies of 2026

We’ve analyzed pricing, coverage, customer reviews, satisfaction, and availability to help you find the best auto insurer based on your unique situation. Here are our top recommendations for 2026:

| Company | Best For | Full Coverage Avg. | Minimum Coverage Avg. | Standout Fact |

|---|---|---|---|---|

| State Farm | Value and Reliable Coverage | $2,030 | $650 | Large agent network, balances cost and service |

| GEICO | Low Rates & Online Access | $1,867 | $558 | Cheapest national brand; DIY tools |

| Progressive | Rideshare Drivers | $2,060 | $702 | Rideshare coverage including delivery for Doordash/Uber Eats in most states |

| Allstate | Coverage Add-Ons | $2,915 | $823 | Numerous discounts and optional coverages |

| USAA | Military & Veterans | $1,533 | $436 | Exclusively serves the military community |

| Direct Auto | High-Risk Drivers | $3,162 | $930 | Coverage for drivers with histories of violations, brick-and-mortar locations |

| Nationwide | Low-Mileage Drivers | $1,987 | $722 | Great pay-per-mile plans |

| Amica | Bundling Discounts | $2,274 | $1,205 | Top for home + auto multi-policy discounts |

| Erie | Customer Satisfaction | $1,833 | $565 | Regional provider with highest J.D. Power claims score |

| Country Financial | Teen Drivers | $1,862 | $681 | Competitive rates for families with teens |

| The Hartford | Seniors | $2,914 | $840 | Exclusive discounts for AARP members |

>>How we pick: Our team weighs national and regional pricing, J.D. Power satisfaction, financial stability, and coverage extras. See the full “Best Of” analysis guide for in-depth profiles and tips for picking the right fit.

What is the most trusted car insurance company?

USAA and State Farm rank among our top choices for best car insurance companies. Both providers have competitive rates, excellent financial strength ratings, consistently receive high marks in third-party customer satisfaction studies.

How do I compare car insurance companies?

To compare car insurance companies, first determine how much coverage you need, and then get quotes from at least three providers. Since your premium depends on your location, driving record, and other factors, you’ll need to get a quote to find out exactly how much you’ll pay. You can also apply qualifying discounts when you get an online quote or speak with an agent.

Which car insurance company has the best rates for high-risk drivers?

Kemper, Direct Auto, GEICO and Progressive are among our picks for high-risk car insurance. Compared to other providers, GEICO usually offers lower rates for high-risk driving profiles, including young drivers, those with bad credit or speeding tickets, and seniors. Progressive has competitive rates for drivers with DUIs.

Who is the cheapest car insurance provider?

USAA and GEICO have some of the cheapest auto insurance premiums, depending on your driving profile and location. USAA is best for military members and families, GEICO provides affordable coverage across all 50 states, regardless of affiliation.

What’s the best auto insurance company for young drivers?

Auto-Owners, USAA, and GEICO are our top choices for young drivers, since they offer the lowest premiums and provide plenty of eligible discounts.

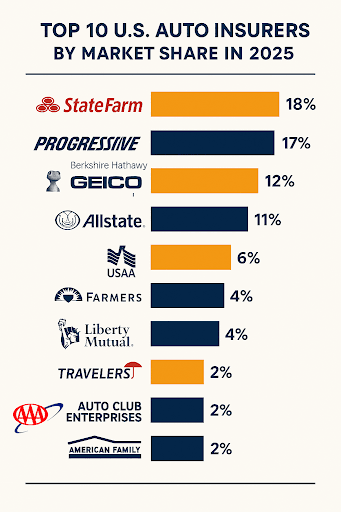

The Biggest Car Insurance Companies

As of 2025, State Farm had the largest market share for private auto insurance, with about 19 percent of the U.S. market share. Progressive and Berkshire Hathaway (which owns GEICO) followed close behind at 17 percent and 12 percent, respectively.1

| Private auto insurance provider | Percent of U.S. market share in 2025 |

|---|---|

| State Farm Mutual Automobile Insurance | 18% |

| Progressive Corp. | 17% |

| Berkshire Hathaway Inc. | 12% |

| Allstate Corp. | 11% |

| USAA Insurance Group | 6% |

| Farmers Insurance Group of Companies | 4% |

| Liberty Mutual | 4% |

| Travelers Companies Inc. | 2% |

| Auto Club Enterprises Insurance Group | 2% |

| American Family Insurance Group | 2% |

A large market share doesn’t necessarily mean it’s the best insurance provider for you, so it’s important to evaluate each company on an individual basis.

DID YOU KNOW?

State Farm, Progressive, and GEICO insure nearly half of all drivers in the U.S. combined.

Compare Auto Insurance Quotes

When it comes to auto insurance, shopping around and comparing quotes is essential for getting the lowest premiums.

Quotes can differ based on factors like these:

- Your driving record, like if you were involved in an at-fault accident with bodily injury

- Your driving habits

- Your credit score

- Whether you drive an Uber or Lyft, as it will require additional coverage

You can save money on car insurance coverage by bundling it with home insurance or life insurance using a multi-policy discount. Make sure to check what your personalized service will cost, what the claims service is like, and how the mobile app is rated on the Apple and Google Play stores. If you file a claim, how soon will you hear back? Does the provider cover your ZIP code? We can tell you all that and more.

Recap

There are hundreds of car insurance companies in the U.S. To find the best company for you, shop around with at least three providers. To help you search, we’ve reviewed the best auto insurance providers on the market.

Sources

PROPERTY AND CASUALTY INSURANCE INDUSTRY 2024 TOP 25 GROUPS AND COMPANIES BY COUNTRYWIDE PREMIUM. National Association of Insurance Commissioners. (2025).

https://content.naic.org/sites/default/files/research-actuarial-property-casualty-market-share.pdf