Guide to Auto Insurance Claims in 2026

Do you know your state’s laws regarding auto insurance claims?

Get quotes from providers in your area

As with all insurance, you purchase auto insurance to protect yourself from losing money in the event of any auto-related theft, injury, or property damage. To cover the expense of any of those incidents, you must file a claim with your auto insurance provider, which reimburses you for the resulting financial expense. However, the claims process isn’t always the most transparent, and it differs based on the state where you live.

We’ll help you brush up on your state’s laws so you can get reimbursed as soon as possible, whether it’s under property damage coverage, comprehensive coverage, or another policy type.

Auto Insurance Claims

An insurance claim is a documented request filed to your insurer to reimburse you for any expense that your insurance policy might cover; it’s usually submitted as a form. You’ll send the form, which details the incident that caused the expense, to the insurer, which will review the details to determine whether the company will cover the incident.

If you’re wondering how long car insurance claims take, keep reading to see your state’s statute of limitations below.

How Do Car Insurance Claims Work?

Here’s how car insurance claims work:

- You file a claim with your insurer.

- Your insurance company determines if it will cover the claim based on your policy.

- If the claim is covered, you’ll first pay the deductible amount included in your policy. That’s how deductibles work; you have to pay them before your insurance kicks in. Learn more about auto insurance deductibles here.

- Once you’ve hit your deductible, your insurance provider will reimburse you for any leftover costs.

- If your claim isn’t covered, you’ll have to pay for your repairs or replacements out of pocket, which will not count toward your deductible.

Why Claims Matter

- More claims means higher premiums. Auto insurance claims matter because events like accidents affect the cost of auto insurance. Of course, if you’re at fault in the accident, your auto insurance premiums may rise, but the insurance company needs to know this information in order to determine your rates. Even before you file a claim, insurance providers use your likelihood of filing a claim to determine your premium costs. People with bad credit, for example, often get worse rates for car insurance than those with good credit, as they’re more likely to file claims.

- Get reimbursed. Maybe your car is being repaired and you need a rental car. Maybe you drove into a pothole and needed to get your tire repaired; how do you actually benefit from your auto insurance? Claims bridge the gap between the insurer and the insured, allowing you to take advantage of your policy and get claims covered. Not all claims are covered, however. Your insurance provider will determine if the policy covers the incident, such as damages from vandalism, as well as who is at fault in a multi-car accident. If the claim is covered, they will give you a payment based on your policy, premiums, and the value of your car.

- Document your car’s damage history. Even if you’ve gotten repairs or replacements, getting into an accident will affect your car’s resale or trade-in value, so claims act as physical evidence of your car’s past.

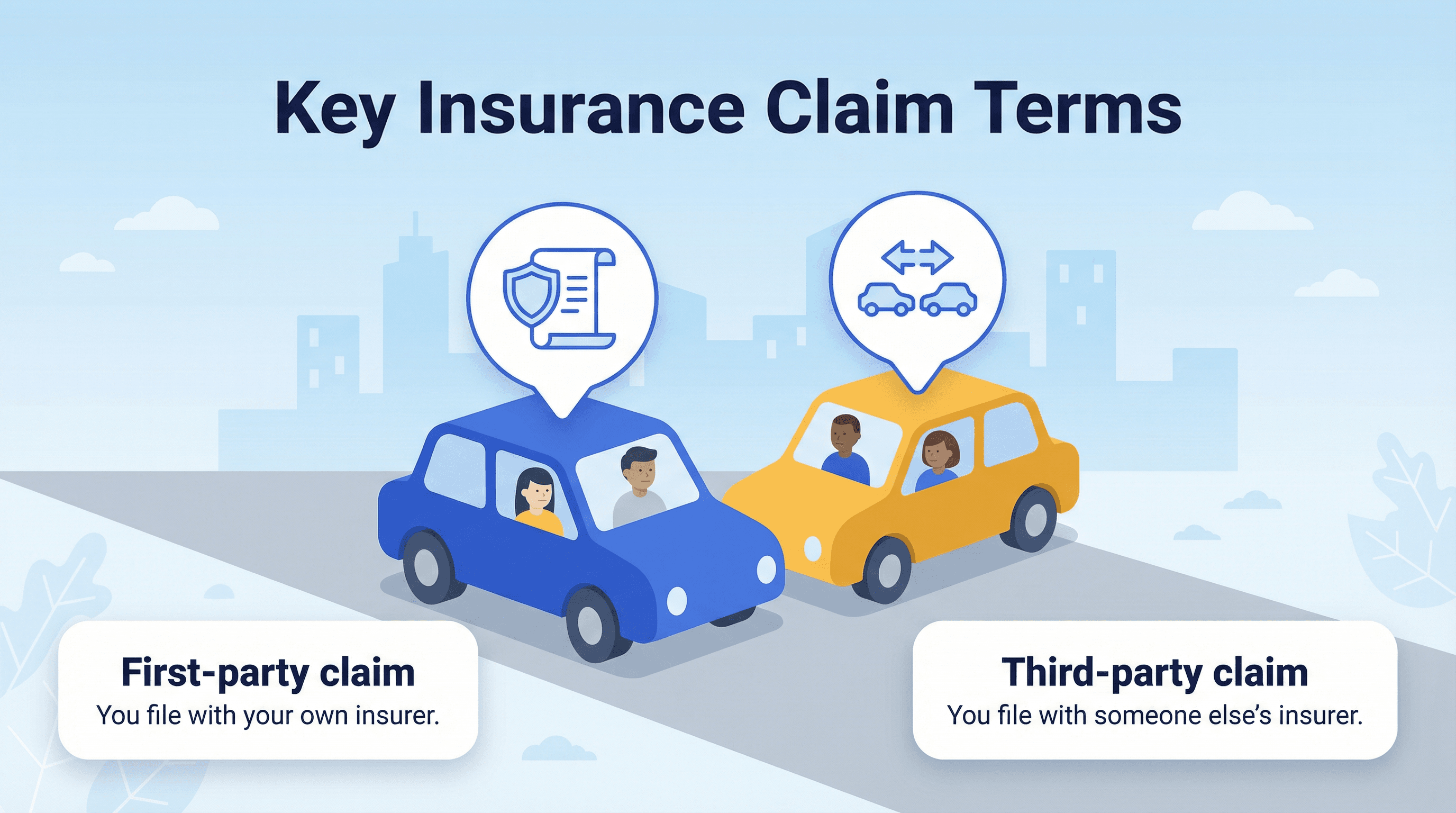

Key Insurance Claim Terms

Before we tell you what to expect while filing an auto insurance claim, let’s define some key terms.

- First-party claim: If you file a claim with your insurance company, that’s a first-party claim.

- Third-party claim: If you’re filing a claim with someone else’s insurance company, that’s a third-party claim.

This image illustrates the difference between filing a claim with your own insurer versus someone else’s.

What to Expect When You File a Car Insurance Claim

Each insurance provider has an obligation to its policyholder, so if someone hits you and you file a claim with their insurer, that company will investigate the claim and offer you a settlement. Here’s some more information about the insurance claims process.

First, you’ll request a claim and the company will send you all the necessary documents. You’ll need to provide information such as who was at fault, the damages and/or bodily injuries, and whether they were related to the accident directly. The insurance company also might make you get several repair estimates, either in network or out of network (except, with the latter, you may have to pay the difference if it’s more expensive than in-network options).

With third-party claims, you won’t have to pay your deductible. Rather, you’ll have to sign a “release for damages” agreeing to the amount you’ll get from the other driver and their insurance provider.

NOTE:

If bodily injury claims are ongoing, you may have to wait to get reimbursed for property damage claims as well.

However, if the other insurer denies your claim, you also have these options:

- File a claim under your policy.

- File a suit in small claims court.

- Hire an attorney and let the judge and jury decide who was at fault and how much is owed.1

With first-party claims, you can file a claim as you would any other claim, paying the deductible first if you haven’t reached it yet.

When to File

How long you have to file your claim depends on your state’s statute of limitations for personal injury and property damage claims. The average is three years for both personal injury claims and property damage claims. That being said, we recommend filing a claim as soon as you can after an incident to speed up the reimbursement and repair processes.

“One common mistake drivers make is delaying the filing of the claim, which can complicate the claims process and potentially lead to the denial of the claim,” says Paul Boudreau, an insurance broker at Rowat Insurance. “If you’ve been in an accident, report it immediately, including photos, witness statements, and a police report.”

| State | Statute of limitations for personal injury claim (in years) | Statute of limitations for property damage claim (in years) |

|---|---|---|

| Alabama | 2 | 2 |

| Alaska | 2 | 2 |

| Arizona | 2 | 2 |

| Arkansas | 3 | 3 |

| California | 2 | 3 |

| Colorado | 3 | 3 |

| Connecticut | 2 | 2 |

| Delaware | 2 | 2 |

| District of Columbia | 3 | 3 |

| Florida | 2 | 2 |

| Georgia | 2 | 4 |

| Hawaii | 2 | 2 |

| Idaho | 2 | 3 |

| Illinois | 2 | 5 |

| Indiana | 2 | 2 |

| Iowa | 2 | 5 |

| Kansas | 2 | 2 |

| Kentucky | 1 | 2 |

| Louisiana | 1 | 1 |

| Maine | 6 | 6 |

| Maryland | 3 | 3 |

| Massachusetts | 3 | 3 |

| Michigan | 3 | 3 |

| Minnesota | 2 | 6 |

| Mississippi | 3 | 3 |

| Missouri | 5 | 5 |

| Montana | 3 | 2 |

| Nebraska | 4 | 4 |

| Nevada | 2 | 3 |

| New Hampshire | 3 | 3 |

| New Jersey | 6 | 6 |

| New Mexico | 3 | 4 |

| New York | 3 | 3 |

| North Carolina | 3 | 3 |

| North Dakota | 6 | 6 |

| Ohio | 4 | 4 |

| Oklahoma | 2 | 2 |

| Oregon | 2 | 6 |

| Pennsylvania | 2 | 2 |

| Rhode Island | 3 | 10 |

| South Carolina | 3 | 3 |

| South Dakota | 3 | 6 |

| Tennessee | 1 | 3 |

| Texas | 2 | 2 |

| Utah | 4 | 3 |

| Vermont | 3 | 3 |

| Virginia | 2 | 5 |

| Washington | 3 | 3 |

| West Virginia | 2 | 2 |

| Wisconsin | 3 | 6 |

| Wyoming | 4 | 4 |

States have exceptions to their statutes of limitations, and there are also some universal exceptions across the U.S., such as in these cases:

- The defendant has left the state.

- The defendant is a minor (under age 18).

- The defendant is legally incompetent.

- The defendant is legally unfit to stand the trial.

- The defendant is imprisoned; you’ll have to wait until they’ve made parole to file a claim with their insurance provider.

- The defendant is dead, in which case you’ll have to make a claim against their estate.

- The defendant is either at war or on active military duty; you’ll have to wait until they’re no longer embattled or have returned from war.

- Both sides have entered a tolling agreement, meaning they agree to waive the statute of limitations to minimize court costs.

- The case is an example of equitable tolling, meaning that the plaintiff couldn’t reasonably have discovered the cause of actions within the statute of limitations. However, this most likely won’t apply to car insurance claims, but instead to home insurance claims of asbestos.

Other factors could reduce the length of the statute of limitations, like car accidents involving:

- Government entities such as government employees, which may reduce the window for filing a claim to only six months.

- Dram shop laws, meaning the state has laws that make bars liable for allowing drunk people to drive. If you live in a state with dram shop laws and your accident involves driving under the influence, the window for filing a claim could shorten to 60 days.2

FYI:

Every state has dram shop laws except for Delaware, Kansas, Louisiana, Nebraska, Virginia, South Dakota, Nevada, and Maryland.3

How to File

Here’s how to file an insurance claim after an incident.

- Collect the following information:

- Vehicle information of everyone involved

- Insurance information of everyone involved

- Contact information for everyone involved

- Location, weather, and time of day for the incident

- Photos of the damage

- Copy of the accident report

- Names of any officers you deal with

- Badge numbers of any officers you deal with

- Ask your agent if your policy covers the incident.

- The agent will send over an insurance adjuster to assess the damage and determine fault, estimating the auto repair cost. As an alternative, you can get an estimate directly from a repair shop, which will then send that information to your insurer. From there, your insurer will decide how much it will cover.

- If your claim is covered, you’ll pay your deductible first.

- If you have rental reimbursement coverage, you can get your car insurer to pay for a rental car while the damage to your car is being repaired.

- Wait for your insurance provider to send your reimbursement money.4

What to Do at the Scene of the Accident

Follow this step-by-step guide to help ensure safety and proper documentation after a car accident.

While preventing accidents isn’t entirely possible even with the best defensive driving skills, you can help yourself and others stay safe after an accident by being prepared. Take these steps if you’re in an accident:

- Pull over to the side of the road or another safer space, if you can.

- Ask everyone involved in the accident if they are physically OK.

- Call emergency services like the police. If there are any injuries, call the hospital as well.

- Visually assess the damage and photograph it.

- Stay at the scene. If you can’t, leave the other people involved your name, address, insurance information, and phone number.

- If you can stay the scene, gather information from everyone involved, including witnesses, such as the following:

- Names

- Contact information

- License plates

- Car registration information

- Insurance identification numbers

- Makes and models of the vehicles involved

- Location

- Time of day

- Weather conditions

- If the police can’t come to the scene, file an accident report with your local police department; you’ll need a police report to file an auto insurance claim.

- File a claim with your insurance provider as soon as possible, even at the scene if it’s safe.

“To keep the process smooth and efficient, make sure to gather all necessary details right after the accident, such as photos, contact information of those involved, and a police report if applicable,” says personal injury attorney Barry P. Goldberg. “Staying organized and keeping a clear record of all communications with your insurer can also help streamline the process and avoid any hiccups.”

Claim Contact Information by Company

Not sure how to file a claim with your insurance provider? Use the contact information below.

| Company | Phone number | URL | Mailing address | |

|---|---|---|---|---|

| 21st Century | 888-244-6163 | None | https://claims.21st.com/cmp/s/filealoss?SO=02 | None |

| AAA | 800-922-8228 | None | Depends on your regional AAA club | Depends on your regional AAA club |

| AARP (The Hartford) | 877-805-9918 | None | https://account.thehartford.com/customer/login | The Hartford

P.O. Box 14219 Lexington, KY 40512 |

| Allstate | 800-255-7828 (for non-Allstate customers filing a claim after an accident with an Allstate customer) | None | https://myaccountrwd.allstate.com/anon/account/login | None |

| Amica | 800-242-6422 | None | https://www.amica.com/customers/login | None |

| Bristol West | 800-274-7865 | None | www.bristolwest.com/home/claims | None |

| Clearcover | 855-444-1875 | None | clearcover.com/claims/ | None |

| Concord | Maine: 800-482-7443

Massachusetts: 800-422-5246 New Hampshire: 800-888-6050 Vermont: 800-660-3838 | None | www.concordgroupinsurance.com/claims/report-a-claim | None |

| Dairyland | 800-334-0090 | None | https://www.dairylandinsurance.com/claims | None |

| Direct | 800-403-1077 | None | https://eservice.directauto.com/service/login | None |

| Erie | 800-367-3743 | None | Find your agent here: https://www.erieinsurance.com/find-an-insurance-agent | None |

| Esurance | 800-378-7262 | None | www.esurance.com/file-a-claim-online | None |

| Farmers | 800-435-7764 | None | https://www.farmers.com/claims/efnol-landing/ | None |

| Foremost | 800-527-3907 | None | https://claims.foremost.com/cmp/s/filealoss | None |

| GAINSCO | 866-424-6726 | None | https://myaccount.gainsco.com/home | None |

| GEICO | 800-207-7847 | None | https://claims.geico.com/ReportClaim#/ | None |

| Good2Go | 800-777-6664 | None | https://direct.good2go.com/submit-request/ | Good2Go Auto Insurance

P.O. Box 1930 Blue Bell, PA 19422-0479 |

| Infinity | 800-463-4648 | None | None | None |

| Kemper | 800-353-6737 | None | https://customer.kemper.com/claims/report/auto | None |

| Lemonade | 844-733-8666 (for claim emergencies) | carclaims@lemonade.com | Use Lemonade insurance app on mobile | None |

| Liberty Mutual | 800-225-2467 | None | https://www.libertymutual.com/log-in?target=claims | Liberty Mutual Group

ATTN: Remittance Processing 100 Liberty Way Dover, NH 03821-7500 |

| Mercury | 800-503-3724 | None | https://mercury.assured.claims/ | None |

| Metromile | 888-595-5485 | None | https://www.metromile.com/dashboard/login | None |

| Nationwide | 800-421-3535 | None | https://claimsservicing.nationwide.com/fileclaim/info/claim-process-intro | None |

| Plymouth Rock | 844-346-1225 | None | efnol.plymouthrock.com/#/login | None |

| Progressive | 800-776-4737 | None | https://account.apps.progressive.com/access/login?fd=accountHome | None |

| Root | New claims: 866-980-9431

Existing claims: 866-489-1985 | None | https://claims.joinroot.com/portal/fnol | Attn: Claims Department

80 E. Rich St., Suite 500 Columbus, OH 43215 |

| Safeco | 800-332-3226 | None | fileaclaim.safeco.com/ | None |

| State Farm | 800-732-5246 | None | https://reportloss.claims.statefarm.com/start-claim | None |

| The General | 800-280-1466 | claims@thegeneral.com | https://www.thegeneral.com/mypolicy/welcome.htm | 600 American Parkway

Madison, WI 53783 |

| Travelers | 800-252-4633 | None | https://www.travelers.com/claims/file-claim/individual | None |

| USAA | Shortcut mobile number: #8722

210-531-8722 or 800-531-8722 | None | https://www.usaa.com/my/logon | USAA

9800 Fredericksburg Road San Antonio, TX 78288 |

How Fault Affects Car Insurance Claims

Fault matters, as the person at fault will have to pay for the damages. In some states, people might share fault, and each could pay for a percentage of the cost. It all depends on the state’s negligence laws, which we’ve outlined below. But before we get to your state, let’s cover the types of negligence laws.

- Contributory: If you’re at fault in any way, you won’t get any money from your insurance company.

- Pure comparative: The share of your fault determines your recovery, so you’ll pay a percentage of the property damage and bodily injury costs.

- Modified comparative: If you’re found 50 percent or more at fault, you won’t get any money from your insurer.

- Slight-gross negligence comparative: You can only recover money from your insurer if you displayed “slight” negligence as opposed to the “gross” negligence of the other party. South Dakota is the only state with this type of negligence law. An example would be a driver running a red light and hitting a pedestrian who is jaywalking. While the driver practiced gross negligence of the law, the pedestrian only practiced slight negligence, so the driver would pay for the pedestrian’s medical costs.

Negligence Laws by State

It’s a good idea to check the type of negligence laws in your state to see how much you’ll pay after an accident.

| State | Type of negligence laws |

|---|---|

| Alabama | Contributory |

| Alaska | Pure comparative |

| Arizona | Pure comparative |

| Arkansas | Modified comparative |

| California | Pure comparative |

| Colorado | Modified comparative |

| Connecticut | Modified comparative |

| Delaware | Modified comparative |

| District of Columbia | Contributory |

| Florida | Pure comparative |

| Georgia | Modified comparative |

| Hawaii | Modified comparative |

| Idaho | Modified comparative |

| Illinois | Modified comparative |

| Indiana | Modified comparative |

| Iowa | Modified comparative |

| Kansas | Modified comparative |

| Kentucky | Pure comparative |

| Louisiana | Pure comparative |

| Maine | Modified comparative |

| Maryland | Contributory |

| Massachusetts | Modified comparative |

| Michigan | Modified comparative |

| Minnesota | Modified comparative |

| Mississippi | Pure comparative |

| Missouri | Pure comparative |

| Montana | Modified comparative |

| Nebraska | Modified comparative |

| Nevada | Modified comparative |

| New Hampshire | Modified comparative |

| New Jersey | Modified comparative |

| New Mexico | Pure comparative |

| New York | Pure comparative |

| North Carolina | Contributory |

| North Dakota | Modified comparative |

| Ohio | Modified comparative |

| Oklahoma | Modified comparative |

| Oregon | Modified comparative |

| Pennsylvania | Modified comparative |

| Rhode Island | Pure comparative |

| South Carolina | Modified comparative |

| South Dakota | Slight-gross negligence comparative |

| Tennessee | Modified comparative |

| Texas | Modified comparative |

| Utah | Modified comparative |

| Vermont | Modified comparative |

| Virginia | Contributory |

| Washington | Pure comparative |

| West Virginia | Modified comparative |

| Wisconsin | Modified comparative |

| Wyoming | Modified comparative5 |

Types of Car Insurance Claims

These are some of the many types of car insurance claims:

- Animal accidents claims

- Bodily injury claims: Bodily injury claims include the cost of medical care for everyone involved in the accident.

- Borrowed car claims

- Flood claims

- Hail claims

- Mechanical claims

- Medical claims

- Natural disasters claims

- Potholes claims

- Property damage claims: Property damage means car damage and damage to other objects or buildings.

- Road hazard claims

- Sinkhole claims

- Theft claims

- Towing/labor claims

- Uninsured/underinsured motorist claims

- Vandalism claims

- Windshield/glass claims

How to Prepare for Accidents

Next time, be prepared in case you get in an accident.

- Keep your car’s proof of insurance, the leasing agent’s name, the registration, and your family’s medical information (including their allergies and doctors’ names) in your car.

- Also keep orange cones, flares, and emergency signage in your car to make sure you don’t get even more hurt after an accident.

- Keep a pen and paper in your car to write down information in case your phone runs out of battery or is damaged and you can’t use your provider’s mobile app.

- Make sure you have appropriate auto insurance coverage.6

Recap

Filing an auto insurance claim can feel overwhelming, but understanding the process can help you navigate it with confidence. Whether it’s a minor fender bender or a major accident, knowing your coverage, documenting the incident, and communicating effectively with your insurer are key to a smooth claim experience. By staying informed and proactive, you can ensure you get the coverage and support you need when it matters most.

FAQs

After you make a claim on car insurance:

- Your insurance provider will investigate the claim and determine a settlement.

- If the claim is covered, you’ll pay your deductible first (if it’s not already paid).

- After you’ve paid your deductible, you’ll get reimbursed for repairs, medical costs, etc.

There is a time limit on car insurance claims that varies by state. The average statute of limitations for both personal injury and property claims in the U.S. is three years each.

However, there is a pretty wide variance. For personal injury claims, the statute of limitations ranges from one year in states like Tennessee to six years in New Jersey. For property damage claims, the range is two to 10 years; Rhode Island is the state with the longest property damage claim statute of limitations (10 years).

While there are some exceptions for minors and incarcerated people, here are the general statutes of limitations by state:

| State | Personal injury claims statute of limitations (in years) | Property damage claims statute of limitations (in years) |

|---|---|---|

| Alabama | 2 | 2 |

| Alaska | 2 | 2 |

| Arizona | 2 | 2 |

| Arkansas | 3 | 3 |

| California | 2 | 3 |

| Colorado | 3 | 3 |

| Connecticut | 2 | 2 |

| Delaware | 2 | 2 |

| District of Columbia | 3 | 3 |

| Florida | 2 | 2 |

| Georgia | 2 | 4 |

| Hawaii | 2 | 2 |

| Idaho | 2 | 3 |

| Illinois | 2 | 5 |

| Indiana | 2 | 2 |

| Iowa | 2 | 5 |

| Kansas | 2 | 2 |

| Kentucky | 1 | 2 |

| Louisiana | 1 | 1 |

| Maine | 6 | 6 |

| Maryland | 3 | 3 |

| Massachusetts | 3 | 3 |

| Michigan | 3 | 3 |

| Minnesota | 2 | 6 |

| Mississippi | 3 | 3 |

| Missouri | 5 | 5 |

| Montana | 3 | 2 |

| Nebraska | 4 | 4 |

| Nevada | 2 | 3 |

| New Hampshire | 3 | 3 |

| New Jersey | 6 | 6 |

| New Mexico | 3 | 4 |

| New York | 3 | 3 |

| North Carolina | 3 | 3 |

| North Dakota | 6 | 6 |

| Ohio | 4 | 4 |

| Oklahoma | 2 | 2 |

| Oregon | 2 | 6 |

| Pennsylvania | 2 | 2 |

| Rhode Island | 3 | 10 |

| South Carolina | 3 | 3 |

| South Dakota | 3 | 6 |

| Tennessee | 1 | 3 |

| Texas | 2 | 2 |

| Utah | 4 | 3 |

| Vermont | 3 | 3 |

| Virginia | 2 | 5 |

| Washington | 3 | 3 |

| West Virginia | 2 | 2 |

| Wisconsin | 3 | 6 |

| Wyoming | 4 | 4 |

Car insurance companies pay out claims by reimbursing customers for their costs. Sometimes, though, in-network service providers such as repair shops, mechanics, and rental car companies will bill the car insurance company directly.

Yes, a car insurance company can refuse to pay a claim if the policy doesn’t cover it. That means the insured person will have to pay for any costs out of pocket. Take these steps if you want to appeal the claim:

- Call your insurance agent and ask about the appeals process.

- If you go through the process and your appeal is denied, contact your state’s department of insurance for help.

- You can also file a complaint with the National Association of Insurance Commissioners.

Citations

Filing a Claim with Another Driver’s Insurance Company. Illinois Department of Insurance. (2022).

https://www2.illinois.gov/sites/Insurance/Consumers/ConsumerInsurance/Auto/Pages/filing-an-auto-claim-with-anothers-insurance-company.aspxCar Accidents: Statutes of Limitations. Enjuris. (2022).

https://www.enjuris.com/car-accident/statutes-of-limitations.htmlDram Shop Laws. FindLaw. (2023, Oct 25).

https://www.findlaw.com/dui/laws-resources/dram-shop-laws.htmlWhat To Expect When You File A Car Insurance Claim. Allstate. (2019, Oct).

https://www.allstate.com/tr/car-insurance/how-to-file-auto-insurance-claim.aspxState by State Negligence Laws. Maloney and Campolo. (2020, Feb 14).

https://www.maloneyandcampolo.com/state-negligence-laws/What to do at the scene of an accident. Insurance Information Institute. (2022).

https://www.iii.org/article/scene-accident