American Family Car Insurance Review 2025

American Family is available in 19 states, and its rates are cheaper than average for many drivers.

Get quotes from providers in your area

Questions? Call us: 844-966-4864

Available in 19 states, largely across the South and Midwest, customers ranked American Family second in the Central region for best customer satisfaction. Although I live in Pennsylvania, which is not one of the 19, I was intrigued by American Family’s long list of discounts along with its average prices for full coverage car insurance, which are under the national average. If you’ve got a teen driver, multiple vehicles on your policy, or a less-than-perfect driving record, consider American Family as one of your best auto insurance options.

Quick Look: American Family Pros & Cons

Pros

Lower-than-average rates for full coverage car insurance

Long list of discounts

Usage-based program for safe driving

Cons

Only available in 19 states

Lower-than-average claims experience ratings

Who Is American Family Auto Insurance Best For?

American Family offers below average rates for drivers with clean records, as well as those with DUIs, poor credit, or a speeding ticket. It’s also worth checking out if your household has a teen drivers, as the company gives discounts for having multiple cars as well as multiple policies, like home and auto bundles. On the other hand, American Family’s rates are above-average for drivers with an at-fault accident.

All that said, your quoted rate may differ widely from the average, so it’s worth getting a quote to see exactly how much you’ll pay.

American Family is available to customers in 19 states:

- Arizona

- Colorado

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- Nevada

- North Dakota

- Ohio

- Oregon

- South Dakota

- Utah

- Washington

- Wisconsin

How much does American Family car insurance cost?

American Family costs an average of $1,936 per year for full coverage car insurance, about 19 percent lower than the national average. When it comes to minimum coverage, American Family is slightly lower than average, costing $604 a year compared to the national average of $635.

| Company | Average annual premium for full coverage | Average annual premium for minimum coverage |

|---|---|---|

| American Family | $1,936 | $604 |

| AAA | $3,014 | $1,056 |

| Allstate | $2,605 | $840 |

| Erie | $1,647 | $581 |

| Farmers | $2,979 | $1,002 |

| GEICO | $1,731 | $517 |

| Nationwide | $1,808 | $718 |

| Progressive | $1,960 | $638 |

| State Farm | $2,167 | $674 |

| Travelers | $1,597 | $576 |

| USAA | $1,407 | $417 |

| National Average | $2,399 | $635 |

If you have a less-than-perfect driving record, you may find lower rates with American Family. In particular, its rates for drivers with speeding tickets and bad credit are lower than the national average, by 11 percent and 16 percent respectively.

| Driver profile | American Family average annual rate for full coverage | National average annual rate for full coverage |

|---|---|---|

| Clean record with good credit | $1,936 | $2,399 |

| Driver with a DUI | $3,091 | $3,305 |

| Driver with an at-fault accident | $3,098 | $2,812 |

| Driver with bad credit | $2,820 | $3,377 |

| Driver with speeding ticket | $2,243 | $2,511 |

How You Can Save On Your Policy with American Family

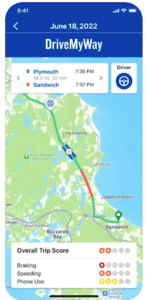

Because I’m a pretty good driver, I’d want to save by enrolling in DriveMyWay, American Family’s usage-based insurance (UBI). Not only would I get a 10 percent discount just for enrolling, but based on how safely I drive, I could save another 5 to 20 percent, more than a decent chunk.

WARNING:

If you display unsafe driving behaviors, your rate could actually increase with the DriveMyWay program.

To sign up, I’d enroll in the program through my agent and download the MyAmFamDrive app on my iPhone. The app would measure my safe driving behaviors for 100 days, and then would give me my discount. For the biggest discount, don’t use your phone while driving, brake softly, drive the speed limit or below, and avoid driving at night.

There was also a low mileage discount, which I’d recommend to anyone who drives less than 8,000 miles per year. Given the amount of people that work from home nowadays, many people could benefit from this discount.

Here is a complete list of the discounts that American Family offers:

- Automatic payments

- Bundle multiple policies like home and auto

- Defensive driver course completion for seniors drivers 55 or older

- Early quote

- Having no accidents, claims, or violations

- Loyalty

- Multiple vehicles

- Paperless billing

- Paying in full

- Good student

- Generational (for young drivers whose parent is a customer)

- Young driver (under 25) who completes 40 hours of volunteer work per year

- Student under 25 more than 100 miles away from home who stores their car at home

- Switch from one of American Family’s competitors

- Vehicle with factory-installed airbags

I find it notable that American Family offers four discounts for young drivers specifically, including one for volunteer work that I haven’t seen elsewhere. Teens are more expensive to insure than drivers in any other age group, so these discounts could go a long way.

My Experience Getting a Quote from American Family

Because I’m from Pennsylvania, when I entered my zip code, I was told that American Family doesn’t offer coverage in my state. However, had I been within American Family’s territory, I could have continued my quote either online, or called a phone number. There was also an option of meeting an insurance agent locally. To find a local agent, all I had to do was enter my zip code.

What types of auto insurance coverage does American Family offer?

In addition to the standard auto insurance coverages, including liability, collision, comprehensive, medical payments coverage, personal injury protection, and uninsured/underinsured motorist coverage, American Family offers a number of add-ons such as:

- Accidental death and dismemberment: For accidents involving deaths or severe injuries like losing a limb, this coverage will pay for more medical costs, regardless of who caused the accident.

- Gap insurance: Gap insurance is required for cars purchased with loans, or cars leased instead of purchased. If you total your car, it ensures that you won’t have to keep making payments on it.

- Rental reimbursement: While your car is in the shop for a covered claim, this coverage will pay for a rental car up to a daily maximum.

- Roadside assistance: When you’re stuck on the side of the road, roadside assistance can provide towing, battery jump starting, tire servicing, delivering of fuel, locksmithing, and even roadside repairs.

DID YOU KNOW?

American Family offers accident forgiveness for someone who has switched from another company and has no accidents for the past five years. If they have an accident with American Family, their rates won’t increase. It’s a good deal, considering some providers require you to have been a customer for several years before offering accident forgiveness.

Note that American Family is not available in every state. Here’s a list of states it is available in:

- Arizona

- Colorado

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- Nevada

- North Dakota

- Ohio

- Oregon

- South Dakota

- Utah

- Washington

- Wisconsin

American Family: Customer Satisfaction Data

Generally, American Family ranks well when it comes to financial strength and customer satisfaction. One exception is its customer reviews from the Better Business Bureau, though it’s worth noting that most insurance companies have poor customer reviews on BBB.

According to the National Association of Insurance Commissions, American Family received fewer than the expected number of complaints for a company of its size, which is not the case with many of its competitors.

| Category | Rating |

|---|---|

| AM Best | A1 |

| Better Business Bureau | A+ rating, 1.13 out of 5-star customer rating2 |

| J.D. Power Customer Satisfaction | 674/1,000 in Central region (above average) |

| Moody’s | Stable |

| National Association of Insurance Commissioners Complaint Index Score | 0.874 (1 is considered average) |

| Standard and Poor’s | A-4 |

On J.D. Power’s Auto Insurance Study, American Family ranked above average for customer satisfaction everywhere except the North Central region. It also ranked below average in the usage-based insurance category5.

| Region | American Family | Average |

|---|---|---|

| California | 672* | 637 |

| Central | 674 | 647 |

| North Central | 642 | 652 |

| Northwest | 655 | 643 |

| Southwest | 656 | 635 |

| Usage-based insurance category | 800 | 821 |

*score is for CONNECT, auto insurance that American Family offers in partnership with Costco

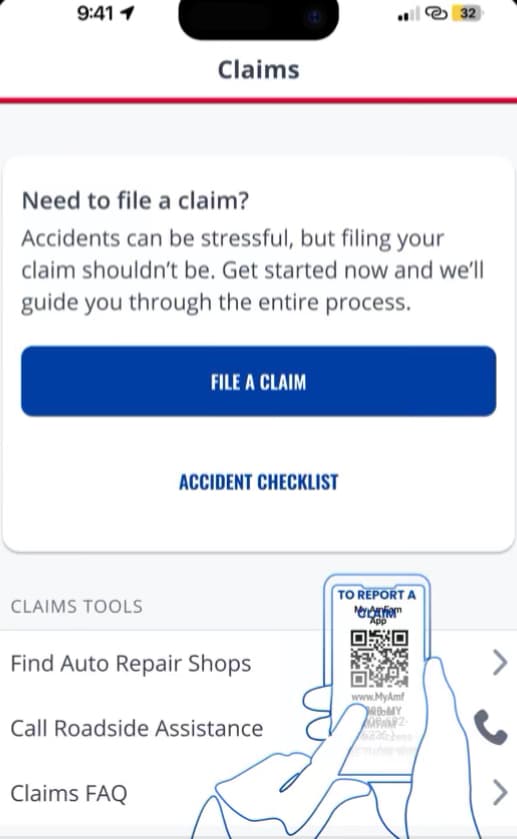

Filing a Claim with American Family

To file a claim with American Family, I could either do it on the website, on the app, over the phone, or in person with a local insurance agent. However, the company makes it clear that the fastest way is to file a claim online or in the app. For vehicle repairs, you can receive payments in as little as one to two days, but accidents with serious injuries will take longer.

In J.D. Power’s 2024 U.S. Auto Claims Satisfaction study, American Family scored below the national average, 692. On the CRASH Network’s 2025 report on claims satisfaction, it ranked 62 out of 97 with a C+ letter grade6. Both reports reflect a less than satisfactory claims experience, which is important to consider when shopping for a provider.

American Family's Website and Mobile App

I found the American Family website to be really easy to use. I could find whatever information I was looking for, for example on discounts and coverages, very quickly. I also had few issues testing out the company’s apps, both the main American Family app as well as the DriveMyWay app, which, confusingly, is called MyAmFamDrive (it just rolls off the tongue, doesn’t it?).

That being said, I think the iPhone apps are better than the Android apps across the board. For example, with the MyAmFamDrive Android app, some users complained that it was overly-sensitive to detecting hard braking, which could raise rates even higher than before. This is a problem I see with many UBI apps. The technology is fairly new, so it often comes with some hiccups. However, I like that AmFam’s customer support responded to the bad reviews, offering customers their assistance.

| App | Rating (out of 5) |

|---|---|

| American Family | iPhone — 4.7 stars

Android — 3.4 stars |

| MyAmFamDrive (DriveMyWay) | iPhone — 4.4 stars

Android — 3.9 stars |

Methodology – How We Review Insurance Companies

We base our reviews on four key factors:

- Price (40%): We evaluate average premiums for both minimum and full coverage across various driver profiles, including safe drivers with good credit and those with accidents, low credit, or DUIs. We also factor in the availability of discounts. For full coverage, in addition to state-mandated coverages, we use the following limits:

- Bodily injury liability: $100,000 per person/$300,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

- Claims Handling (25%): Efficient claims processing is a core service of an insurance provider. We consider transparent communication, accessible customer support, and fair, timely payouts as key indicators of good claims practices. Our assessment includes independent sources like the CRASH Network Insurer Report Card and J.D. Power’s Claims Satisfaction Report, and financial strength ratings from AM Best and S&P. Where possible, we include real customer experiences.

- Customer Experience (25%): We assess customer experience from start to finish, from obtaining quotes and purchasing a policy to making changes or accessing documents. The presence of local agents and the quality of online services are also considered. Our analysis draws from J.D. Power studies, the NAIC complaint index, BBB ratings, and app store reviews.

- Coverage Options (10%): We look at the coverage options offered by each company, giving preference to providers that offer add-ons like accident forgiveness, gap coverage, rideshare coverage, and more.

Read more about our methodology and ratings.

Frequently Asked Questions

Overall, American Family has affordable rates, many auto insurance discounts, and strong financial and customer strength ratings. It’s a great option for drivers of all profiles, including young drivers and those with a DUI.

American Family is actually not so expensive. The average annual cost of full coverage is only $1,936 at American Family, while the national average is $2,399, 19 percent higher. The provider also offers lower-than-average rates for high-risk drivers with bad credit or a DUI. That being said, American Family is, on average, slightly more expensive than the national average for drivers with an at-fault accident.

There is no other insurance company that owns American Family Insurance. Rather, it is a subsidiary of American Family Mutual Insurance Company, according to the U.S. Securities and Exchange Commission.

No, American Family is not the same as The General. American Family acquired The General in 2012 and continued operating both companies separately. In 2024, American Family Insurance sold The General to Sentry.

The states that have American Family insurance include:

- Arizona

- Colorado

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- Nevada

- North Dakota

- Ohio

- Oregon

- South Dakota

- Utah

- Washington

- Wisconsin

Citations

AM Best Revises Issuer Credit Rating Outlook to Stable for American Family Mutual Insurance Company, S.I., Core Affiliates and American Family Life Insurance Company AM Best. (2024, Oct).

https://news.ambest.com/PR/PressContent.aspx?altsrc=2&refnum=35331Business Profile: American Family Insurance. Better Business Bureau. (2025).

https://www.bbb.org/us/wi/madison/profile/insurance-companies/american-family-insurance-0694-5002017Results by Complaint Index. NAIC. (2025).

https://content.naic.org/cis_refined_results.htm?TABLEAU=CIS_COMPLAINTS&COCODE=10386&REALM=PROD&COCODE=10386&REALM=PRODAmerican Family Mutual Outlook Revised To Stable From Negative On Revised Criteria; ‘A-‘ Ratings Affirmed

. S&P Global. (2024).

https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/3131479Trust Emerges as Top Driver of Customer Satisfaction with Auto Insurance as Prices Continue to Surge, J.D. Power Finds

. J.D. Power. (2024, Jun).

https://www.jdpower.com/business/press-releases/2024-us-auto-insurance-studyTop Rated U.S. Car Insurance Companies for 2025. Crash Network. (2025).

https://www.crashnetwork.com/irc/