GEICO DriveEasy Review 2025

GEICO DriveEasy offers an upfront discount, but it can increase your rates.

Get quotes from providers in your area

Questions? Call us: 844-966-4864

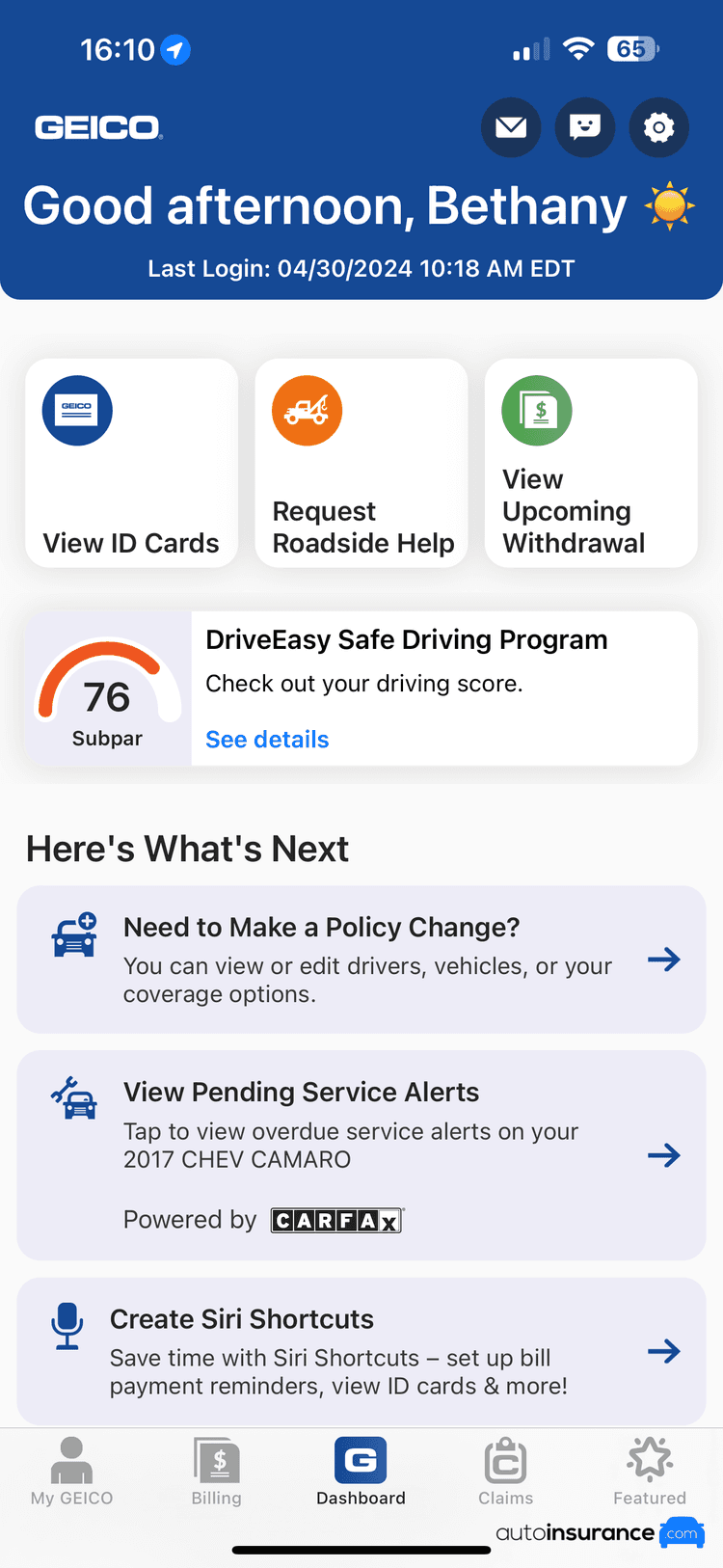

GEICO markets DriveEasy as an easy way to reward safe drivers with savings. The program is integrated into the GEICO mobile app, making it simple to sign up and start tracking your driving. You’ll receive an upfront discount just for enrolling, and after 45 days, the app will generate a driving score that determines whether you’ll receive a discount or a surcharge at your next policy renewal.

In this review, I’ll walk you through how DriveEasy works, what discounts to expect, and whether the discount program is right for you. My review is based on industry research and experiences directly from a DriveEasy customer.

In addition to DriveEasy, we’ve reviewed other safe driving discount programs, like Allstate Drivewise and State Farm Drive Safe & Save. If you’re an older driver looking for ways to save, we’ve put together a safe driving guide for older adults.

GEICO offers cheap rates nationwide.

And you can save even more when you sign up for DriveEasy. Get a GEICO quote today.

Quick Look: GEICO DriveEasy Pros and Cons

Pros

Integrated into the GEICO mobile app

Drivers save up to 15% when renewing

Offers feedback to encourage safe driving

Cons

Can raise your rates

Requires all drivers on a policy to enroll

What Does GEICO DriveEasy Monitor?

GEICO DriveEasy is a discount program that uses an app to track your driving behavior through the GEICO mobile app. DriveEasy bases your driving score on the following:

- Distractions: Avoid using your phone when driving

- Braking and Acceleration: Slow down and speed up gently

- Cornering: Drive around corners at low speeds

- Smoothness: Maintain consistent speeds

The app also tracks other factors, including late-night driving, distance driven, weather conditions, and route consistency, and uses this information to calculate a driving score. As you use DriveEasy, you’ll receive driving tips to help you raise your score and maximize your savings.

How Much Do You Save With GEICO DriveEasy?

GEICO advertises savings between 5 to 15 percent with DriveEasy. If you have multiple drivers on a policy, all drivers must use DriveEasy for you to qualify for the discount.

Before you sign up, be aware that the app can raise your rates if it detects risky driving behavior. Additionally, like virtually all safe driving programs, customers report it is near impossible to earn a significant discount for safe driving.

When Do You Start Earning the DriveEasy Discount?

Your driving score will apply to your premium during the next policy period. Unlike some usage-based discount programs from other providers, like Allstate Drivewise, GEICO doesn’t require a minimum number of trips to earn a higher discount. As you continue using DriveEasy, you’ll see discounts reflected at each policy renewal based on your latest driving score.

Insights from Other GEICO DriveEasy Users

In addition to sharing our team’s personal experiences with DriveEasy, we analyzed real-life customer feedback and review patterns to understand what other drivers think. By analyzing over 1,500 customer reviews from major platforms like Reddit, BBB, and more, we identified common themes in customer satisfaction, complaints, and overall experience. Here’s what we found:

| Category | Details |

|---|---|

| Total Reviews Analyzed | ~1,600 reviews analyzed (Reddit, Trustpilot, BBB) |

| Top 3 Positives |

|

| Top 3 Negatives |

|

| Key Takeaway | GEICO DriveEasy is user-friendly and can improve driving awareness. It rewards consistently cautious drivers with discounts, but other consumers report inconsistent results. Some see real savings; others are frustrated by harsh scoring and minimal financial reward. |

How Does GEICO DriveEasy Work?

Setting Up DriveEasy

Getting started on DriveEasy is easy since it’s already integrated into the GEICO mobile app. Once you log in, select the DriveEasy icon. You’ll be directed to a screen to accept permissions to allow the app to log your trips automatically. I spoke to a colleague who is a DriveEasy customer, and she confirmed that the app is easy to set up and runs unobtrusively in the background.

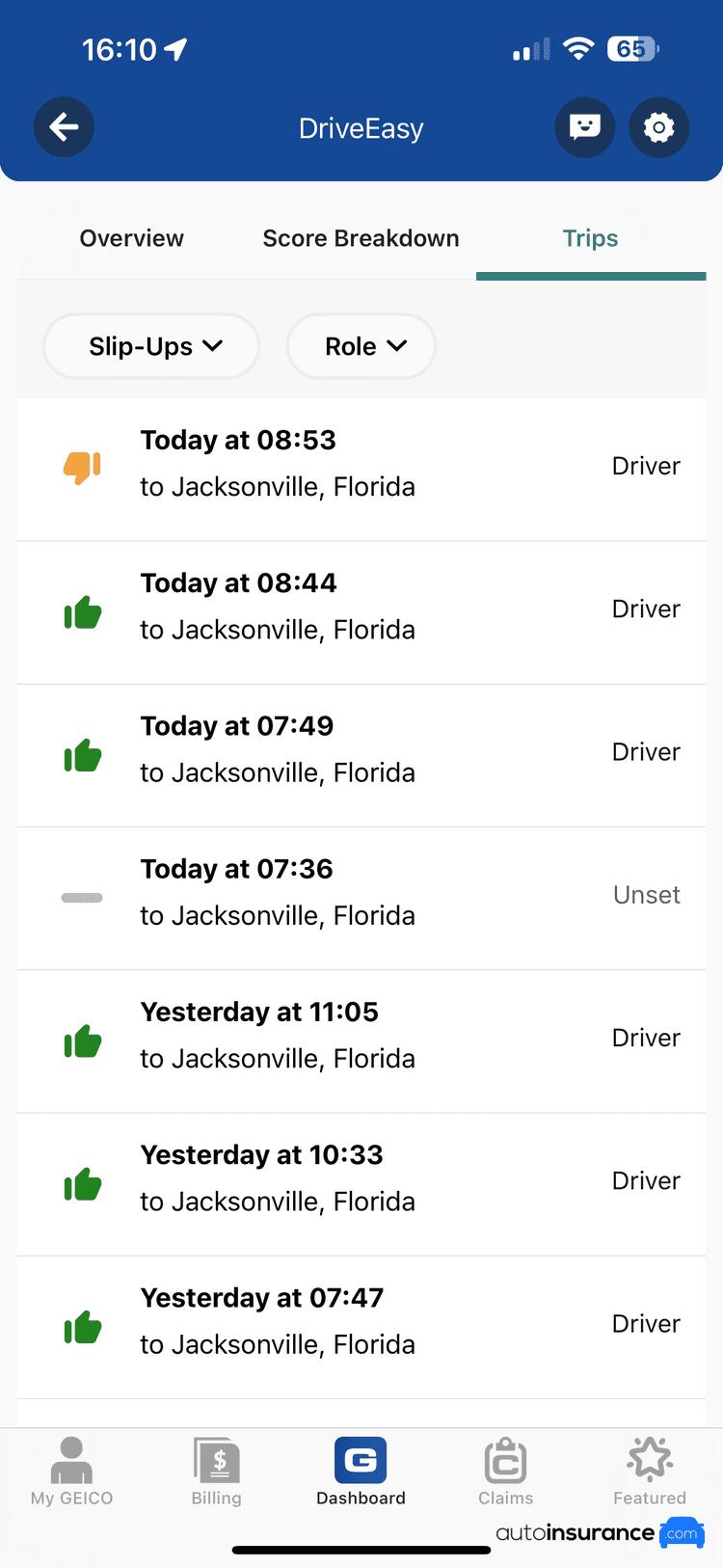

Trip Tracking

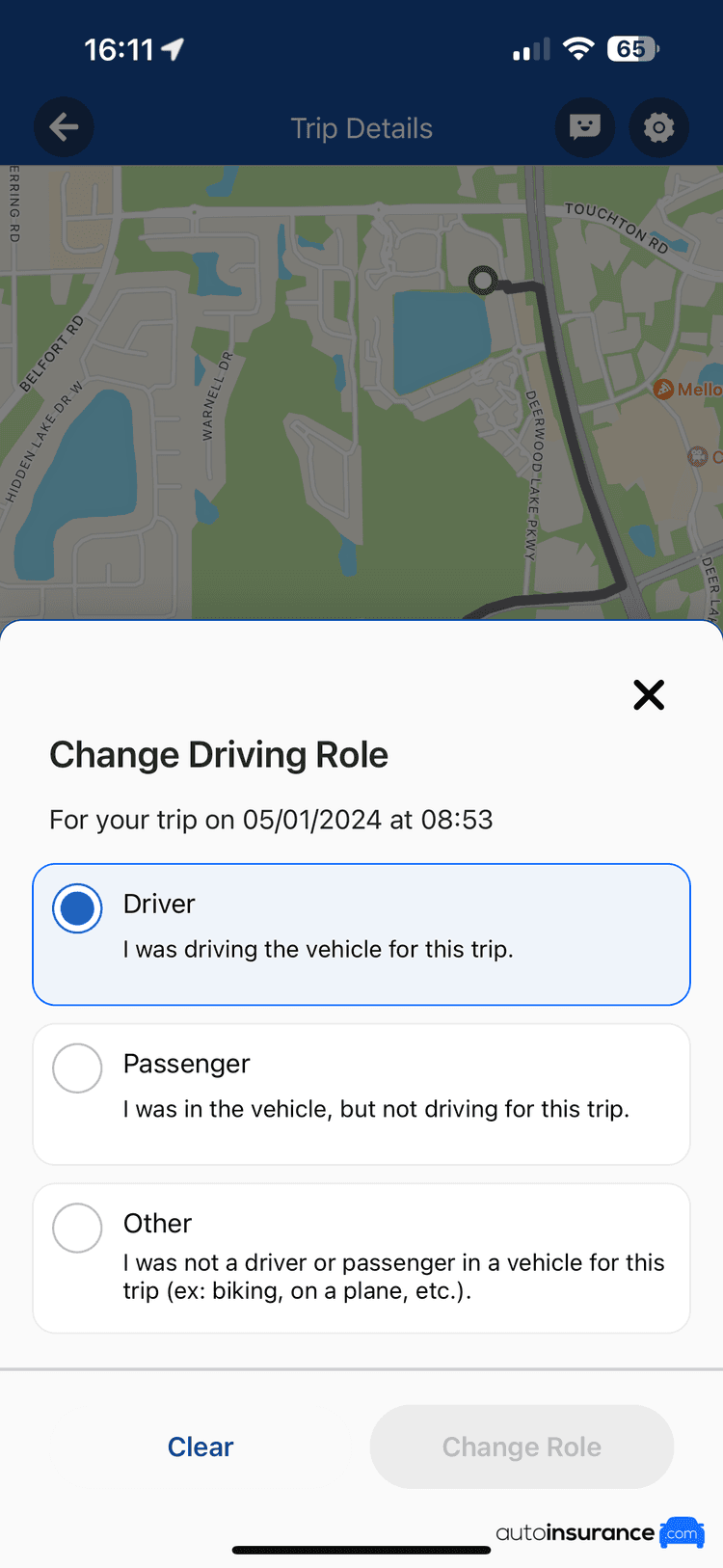

The DriveEasy app automatically tracks when you’re driving, which is convenient—for the most part. The downside to automatic trip-tracking is that when you’re a passenger—even in another vehicle, like a taxi or rideshare—you’ll need to manually update your driving role on the app to keep it from impacting your driving score.

This problem is not unique to DriveEasy—other app-based programs, like Allstate Drivewise and Liberty Mutual RightTrack, have the same issue. Programs that give you an option to track your driving with a plug-in device, like State Farm Drive Safe & Save or Progressive Snapshot, don’t have this same issue.

My colleague reports it’s a simple process to change her status for a trip from driver to passenger, which you can see in the screenshot below.

Another downside of DriveEasy is if you use your phone at all while driving, it’ll be counted as a distraction incident. My colleague reports that using CarPlay or Siri on the infotainment screen in her car counts as a distraction incident (equivalent to unlocking her phone and using it while driving), even for simple gestures like advancing her song choice while listening to music in the car.

Finally, while not specific to DriveEasy, my colleague reports that she has to constantly re-enroll in FaceID in the GEICO app, despite selecting to continually use the option.

Data Privacy

When you use the DriveEasy app, GEICO tracks your location at all times. The provider states that it doesn’t sell any driving info the app collects to third parties. However, its privacy policy mentions that it may share your location data with third parties in its business operations, which include service providers, state insurance departments, and other law enforcement authorities.1 Some customers report concern with the amount of data DriveEasy collects; if you’re concerned about data privacy, it may be better to opt out of DriveEasy.

Accident Assist

If DriveEasy detects a hard brake, it will send a notification to see whether there’s been an accident. You can indicate on the app if you need assistance, and GEICO will use your tracked location to reach emergency services or get your car towed. If you’ve been in a covered incident, you can also get claims support. Accident Assist is included for free and can be helpful in an emergency.

App Store and Google Play Reviews

I checked out customer reviews for the DriveEasy app to see how users feel about it.

| App | Rating (out of 5) |

|---|---|

| Android (Google Play) | 4.6 stars |

| iPhone (App Store) | 4.8 stars |

Since DriveEasy is integrated into the GEICO mobile app, I looked specifically at customer reviews about DriveEasy itself. Multiple customers mention that driving in a city racks up more penalties, marking frequent red light stops as hard braking and that DriveEasy can’t always distinguish between driving and walking once the car is parked. Reviews also mention that the app drains their phone’s battery.

GEICO DriveEasy vs. the Competition

Here’s how Drivewise compares to other major insurance companies’ usage-based discounts.

Perhaps most notably, GEICO’s advertised discount of 15 percent is much lower than competitors like USAA SafePilot and State Farm Drive Safe & Save’s maximum 30 percent discount.

| Discount program | Maximum discount (often varies by state) | Enrollment discount (often varies by state) | What it tracks | Tracking method | Review period |

|---|---|---|---|---|---|

| GEICO DriveEasy | 15% | Not stated |

| App only | Each policy renewal (usually 6 months) |

| Allstate Drivewise | Not stated | Not stated |

| App only | 50 trips; discount on renewal |

| State Farm Drive Safe & Save | 30% | 10% |

| Bluetooth device | Every 6-month renewal (first 90 days counted for initial discount) |

| USAA SafePilot | 30% | 10% |

| App only | 325 miles/16 hours, then each policy renewal |

| Nationwide SmartRide | 40% | 10% |

| App or plug-in device | 80 days |

| Liberty Mutual RightTrack | 30% | 10% |

| App only (except in New York) | 90 days |

| Progressive Snapshot | $322 on average, according to Progressive2 | $169 average |

| App or plug-in device | Usually after 6 months |

Alternatives to GEICO DriveEasy

If DriveEasy doesn’t seem like the right fit for you, GEICO offers several other ways to save on auto insurance:

- Good driver: GEICO lowers rates for drivers who have been accident-free for five years.

- Vehicle equipment: Enjoy a discount for having airbags, anti-theft systems, daytime running lights, and anti-lock brakes.

- Good student: Full-time students with at least a “B” average can save money on your premiums.

- Payment history: Consistently paying your premiums on time can help reduce costs.

- New vehicle: Pay less for your policy if you own a car that is three years old or newer.

- Multiple policies: Bundle auto and home insurance and get discounts on both policies.<

The Bottom Line: Is GEICO DriveEasy Worth It?

For safe drivers, enrolling in DriveEasy may be worthwhile for safe drivers who want to earn discounts of up to 15 percent. Even if you don’t hit the maximum, every little bit helps lower your premiums. Keep in mind that the app may raise your rates for risky driving, so if your habits behind the wheel aren’t up-to-par, DriveEasy likely isn’t worth it.

DriveEasy Is Best For You If You:

- Practice safe driving habits and avoid using your phone while on the road

- Want to maximize your auto insurance discounts

- Prefer to use an app, rather than a device, to track your driving

DriveEasy Is Not Best for You If You:

- Frequently drive after 11 p.m.

- Are concerned about data privacy or your rates increasing

- Live in one of the following places, where DriveEasy isn’t available:

- Alaska

- California

- Delaware

- Hawaii

- Kansas

- Maine

- Montana

- New Hampshire

- North Dakota

- Rhode Island

- South Dakota

- Vermont

Why You Can Trust Our Reviews

We use the following methodology to assess usage-based insurance discount programs like GEICO DriveEasy.

Tracked Behaviors and Data

We look at what data the program uses to dictate discounts. Programs usually keep track of speed, braking habits, acceleration, cornering, miles driven, phone use while driving, and the time of day you’re driving. We prefer programs that detect trips automatically. Ideally, the insurance company encrypts this data and doesn’t disclose it to third parties for marketing purposes.

Availability

We examine where the program is available, since not all programs are available in all locations. We also consider whether the discount varies by state, and the discount discrepancies.

Telematics Technology

Programs may offer a mobile app, plug-in or Bluetooth device, or a combination of both. Although mobile apps provide a simpler setup than plug-in devices, they can drain your phone’s battery life and often count trips taken as a passenger towards driving scores. When the discount program requires an app, we look at its ratings on Google Play and the Apple App Store.

Rates

We are partial to programs that give potential savings of up to 30 percent or more, along with discounts upon sign-up. Also, an important aspect we consider is whether the program could make your rates more expensive instead of reducing them. Select programs can increase your premiums for risky driving habits, so we prefer programs that won’t penalize drivers for their driving habits.

DriveEasy Frequently Asked Questions

Yes, it’s possible for DriveEasy to increase your premium. Depending on your driving habits and your location, using DriveEasy may raise your rates. On its website, GEICO states , “Riskier drivers may see a higher rate — depending on the state you live in.” Contact a GEICO representative to confirm whether DriveEasy can increase rates in your state.

You have to use DriveEasy for at least 45 days in order to get a driving score and earn a potential discount (or a surcharge) at your next renewal.

Yes, DriveEasy tracks your speed using your phone to help determine your driving score. When you enroll in DriveEasy, you must share your location with the app in order to participate in the program.

No, you don’t have to use DriveEasy with GEICO. While it’s integrated into their mobile app, DriveEasy is an optional discount program that drivers can use to save on their premiums

The maximum discount on GEICO DriveEasy is 25 percent, although all drivers enjoy an initial 10 percent discount just for signing up.

The maximum discount on GEICO DriveEasy is 15 percent.

Yes, you can cancel DriveEasy and unenroll from the program by contacting a GEICO customer service representative by phone or chat. GEICO states that drivers may face a fee for unenrolling from the program, so check the DriveEasy requirements for your location.

Citations

Privacy Policy. GEICO. (2025).

https://media.geico.com/legal/privacy_policy.htmGet Snapshot from Progressive. Progressive. (2025).

https://www.progressive.com/auto/discounts/snapshot/