Progressive Snapshot Review 2025

Is it worth signing up for Progressive’s usage-based insurance discount?

Get quotes from providers in your area

Questions? Call us: 844-966-4864

Like most other major insurers, Progressive offers a usage-based telematics discount that rewards you with savings based on how safely you drive. Progressive’s program is called Snapshot, and according to the company, safe drivers who enroll save an average of $231 at policy renewal.

You can enroll in Snapshot when you first purchase your policy or by calling Progressive. You’ll get a discount just for signing up, and then you’ll likely see a larger discount at your next policy renewal based on your driving habits. Snapshot may actually increase your rates for unsafe driving, which is an important consideration.

I’m a senior editor and analyst at AutoInsurance.com, and although I’m a State Farm customer, I connected with two of my coworkers who use Progressive Snapshot to be able to provide first-hand experiences of the program. I can also compare it to State Farm’s Drive Safe & Save program, which I’m enrolled in.

Here’s what you need to know about Progressive’s Snapshot discount program. We’ve reviewed other safe driving discount programs, including Allstate Drivewise and Nationwide Smartride. Looking for more savings? Check out our guide on ways to lower your insurance costs.

Safe drivers save with Progressive Snapshot.

Progressive reports users save an average of $169 at sign-up and $322 at renewal.

Quick Look: Progressive Snapshot Pros and Cons

Pros

Save just for enrolling, and get a potentially bigger discount at renewal

Available via mobile app or plug-in device

Includes crash detection feature

Cons

Discount not available in California, and sign-up discount not available in Hawaii or New York

Mobile app not available in all states

Can increase your rate for risky driving

What Is Progressive Snapshot?

Snapshot is Progressive’s usage-based telematics insurance program that can offer you a discount on your premium if you drive safely. Here’s what it tracks:

- Braking and acceleration: Don’t slam on the brakes, and avoid accelerating too quickly

- Night driving: Limit nighttime driving — 12 a.m. to 4:00 a.m. on weekends

- Miles driven: The less you drive, the higher your potential discount

- Phone use: Don’t use your phone while your car is in motion

DID YOU KNOW?

Based on data from the National Highway Traffic Safety Administration, 3,275 people were killed by distracted driving in 2023.1

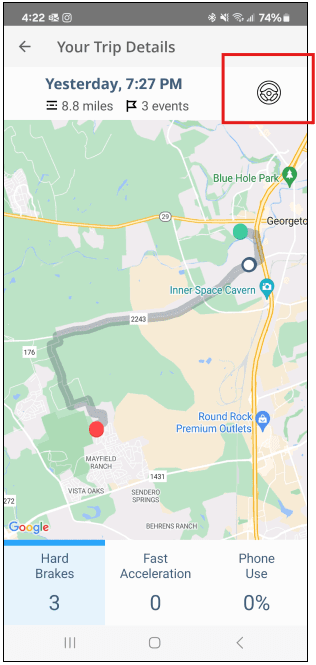

Progressive states that braking hard a few times shouldn’t impact your score and, subsequently, your discount, but it becomes an issue if its data shows that this is a frequent driving habit of yours.

The program only takes phone use into account when calculating your discount in certain states and only if you use the mobile app. If you use the plug-in device, phone use will not be considered. Phone use tracking is a feature of State Farm’s program that I find slightly annoying since the app records phone use even if I’m not using it — which I never do — including if a passenger is checking directions.

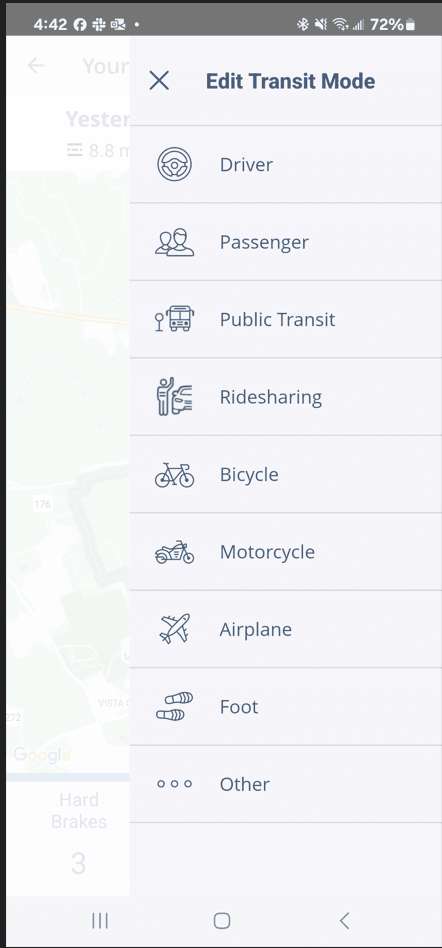

The same seems to be true of Snapshot. One of my coworkers noted that their app tracks even GPS usage, which they find frustrating even though they don’t live in a state where it affects their discount. Other Snapshot users report that phone use cannot be manually modified after a trip without completely reclassifying it as a passenger trip (State Farm, on the other hand, lets you classify a trip as a driver with a passenger using your phone), in which case none of the data will count. So if phone use may impact your Snapshot discount in your state, these are considerations to keep in mind.

How Much Do You Save With Progressive Snapshot?

Progressive doesn’t advertise maximum percentage discounts for Snapshot, but it claims that safe drivers using the program save $231 on average when they renew their policy and $169 on average at signup.

One of my coworkers who uses Snapshot is able to save 15 percent on their premium per six-month policy period. The amount you save will depend on where you live. For example, sign-up discounts are not available in Hawaii or New York — you’ll have to complete the program before you see a discount reflected in those states.

It’s also important to keep in mind that Snapshot may actually increase your premium in certain states if the app or plug-in device detects unsafe driving behavior, which is a potential risk to keep in mind if you engage in risky driving. Progressive states that around two in 10 drivers experience a rate increase as a result of using Snapshot. This is something I don’t have to worry about with State Farm, as Drive Safe & Save can only lower your premium.

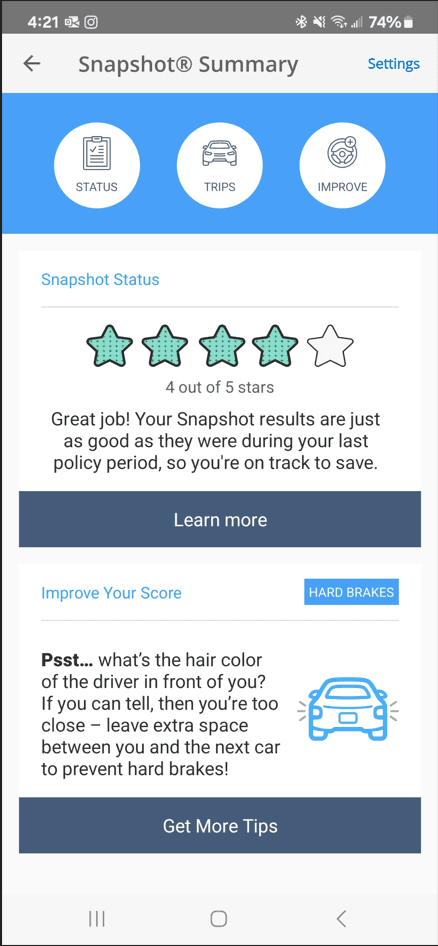

Snapshot users can view their driving performance and reports at any time on the Snapshot app, or by logging into their online Snapshot account.

When Do You Start Earning the Snapshot Discount?

When you enroll in Snapshot, you’ll get a small discount on your initial policy period unless you live in New York or Hawaii (or California, where Snapshot isn’t available at all). Then, you’ll participate in the program for the duration of a policy period, which is either six or 12 months, depending on your policy.

At the next policy renewal, provided that Progressive has collected enough of your driving data, you’ll receive a discount — or a rate increase — based on your driving habits. The way the program works is very state-specific.

In some states, you’ll participate in the program for one policy period, and your driving results will apply for the remainder of the lifetime of your policy. However, the corresponding discount or rate increase may change over time. In other states, you’ll use the program continuously, and your driving results and subsequent rate change will be updated at every renewal. After your renewal after enrollment, Snapshot will email you directly with your personalized rate.

If you opt out of the program within 45 days of enrolling, your sign-up discount will be removed. If you opt out after 45 days, you may get a surcharge at your next renewal, depending on your state.

Households With Multiple Drivers

Progressive Snapshot works with multiple cars or drivers on your policy, but it doesn’t provide a discount for doing so. This process is also state-dependent: in some states, each driver on the policy will have to choose which car they drive most frequently when they download the app and enroll in the program. Their smartphone will then be associated with that particular car, but they can still drive other cars as well.

In other states, the program simply averages driving data from all smartphones and vehicles. If you have teens or inexperienced drivers on your policy, be particularly prudent about having them sign up since your rates may be most likely to increase.

How Does Progressive Snapshot Work?

Enrollment

You can decide to enroll in Snapshot as soon as you purchase your Progressive auto insurance policy or later on by calling Progressive. In certain states, the mobile app option isn’t available, and in others, it’s only available if you sign up when you purchase your policy. If you decide to enroll in the program at a later date, you’ll need to use the plug-in device in these states.

If you live in a state where the mobile app option is available and decide to go that route, all you need to do is download the Progressive app, as Snapshot is integrated into it. Below is what the Snapshot home screen within the app looks like, which shows your current score and a driving tip:

Trip Tracking

Snapshot tracks your trips using either the mobile app or a plug-in device, depending on your state and personal preference. Setting up the app is faster since you’ll have to wait seven to 10 days to receive the physical device after you enroll. However, it’s very easy to use once you receive it — you just plug it into the OBD-II port in your car, which is usually under the steering wheel.

TIP:

Depending on your car model, the OBD-II port may be located to the left, middle, or right beneath your steering wheel. If it’s not there, check around the pedals.

Using the plug-in device has the added benefit of only tracking the trips you take in your car, so you won’t need to worry about it detecting rideshare trips, for example. However, it may not accurately detect trips in your car for which you are the passenger, which is also an issue with the mobile app. You have the option of simply unplugging it unless the driver is someone else on your policy who wants their own trip to be tracked. In most cases, I would recommend using the plug-in device over the app if it’s an option.

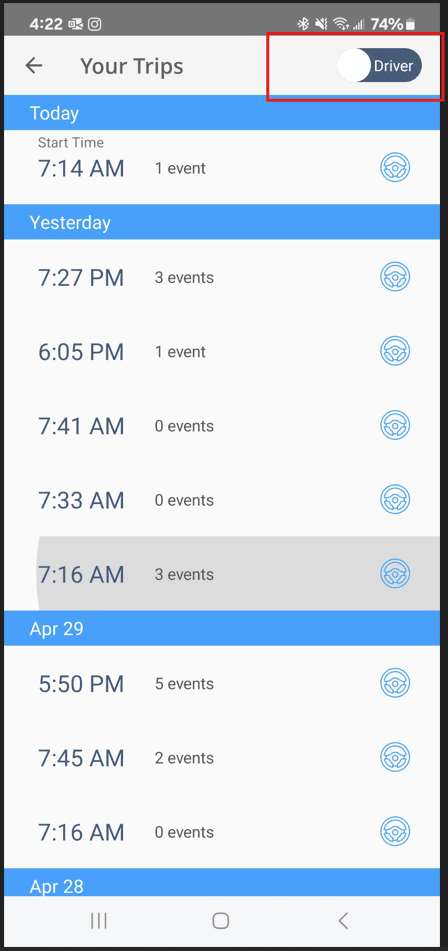

If a trip has been incorrectly tracked, you’ll need to go into the app or your online account to manually edit it. You can filter by trips where you were the driver, as shown below in the app. You can edit the transit mode by tapping the steering wheel icon in the top right.

The State Farm program uses both a mobile app and a Bluetooth-enabled beacon that connects to my phone, so the app only tracks trips that I take in my car, which I find convenient. However, if you don’t often ride in other cars, this will be less of a concern.

The Progressive plug-in device also beeps when it detects hard braking, which some may find annoying, but it can help you recognize potentially problematic driving behavior in real-time and avoid future dings to your score.

Data Privacy

In order to track your trip information, Snapshot uses your phone location and usage data. This is a non-negotiable part of any usage-based insurance discount program. According to Progressive’s Snapshot privacy statement,2 all Snapshot data, whether it’s from the plug-in device, the app or third-party sources, is encrypted when it’s transmitted to the company.

Data on the device is deleted once it’s sent to Progressive, and data on the app is deleted after several days (an overview report remains available, however). Progressive may also share data with its partners for marketing purposes.

FYI:

According to our study on data privacy and telematics apps, almost 70 percent of drivers are concerned about the data privacy issues of usage-based insurance, while 59 percent are worried their driving data may not be accurately collected.

Crash Detection

Progressive Accident Response is part of the Progressive mobile app, so it’s available to Progressive customers even if they’re not enrolled in Snapshot. State Farm has a similar feature in its Drive Safe & Save app, which is nice to have.

The Progressive app will send a notification if it detects that you’ve been in an accident. Depending on how you respond, a representative will try calling you to either connect you to emergency services or offer to send a tow truck or other roadside services.

Third-Party Reviews

Both of my coworkers who use Snapshot use it via the Progressive mobile app and shared that it was easy to set up. Their main complaints are that the app does not differentiate whether they are the driver or the passenger and does not allow them to indicate this upfront — you have to wait until the trip is logged and then go back and edit it, which is easy to forget.

I also looked at app store reviews to gather more robust feedback data. The Progressive mobile app has mostly positive reviews in both the Apple App Store and Google Play Stores. As with most apps, it has a higher average rating from iPhone users, but only slightly.

| App | Rating (out of 5) |

|---|---|

| Android (Google Play) | 4.6 stars |

| iPhone (App Store) | 4.8 stars |

The most common complaints about the app include:

- Inaccurately sensing whether someone is the driver or the passenger, echoing my colleagues

- Detects phone use even if a passenger is using the phone or GPS is on

- Inefficient roadside assistance

Most positive reviews are about the app being user-friendly. For Snapshot specifically, users note that it helps them focus on and improve their driving. Many reviewers also enjoy being able to review trip details and driving habits.

Progressive’s J.D. Power satisfaction score for usage-based insurance is 816 out of 1,000.3 This is a little lower than the segment average of 821. Nationwide has the highest score for UBI insurance in the segment (842) and Farmers has the lowest (769). Still, the score range is fairly minimal, suggesting that many drivers have a positive experience with UBI insurance, regardless of their provider.

Progressive Snapshot vs. the Competition

Here’s how Snapshot compares to other major insurance companies’ usage-based discounts:

| Discount program | Maximum discount (often varies by state) | Enrollment discount (often varies by state) | What it tracks | Tracking method | Review period |

|---|---|---|---|---|---|

| Progressive Snapshot | $169 on average, according to Progressive | $231 average |

| App or plug-in device | Usually after 6 months |

| Allstate Drivewise | Not stated | Not stated |

| App only | 50 trips; discount on renewal |

| State Farm Drive Safe & Save | 30% | 10% |

| Bluetooth device | Every 6-month renewal (first 90 days counted for initial discount) |

| GEICO DriveEasy | 15% | 5% |

| App only | Each policy renewal (usually 6 months) |

| USAA SafePilot | 30% | 10% |

| App only | 325 miles/16 hours, then each policy renewal |

| Nationwide SmartRide | 40% | 15% |

| App or plug-in device | 4-6 months |

| Liberty Mutual RightTrack | 30% | 10% |

| App only (except in New York) | 90 days |

Alternatives to Progressive Snapshot

If you prefer not to participate in the Snapshot program, there are other car insurance discounts you can take advantage of with Progressive:

- Bundling: If you have more than one type of policy with Progressive, such as auto and home insurance, you can save on both.

- Good student: Full-time students who maintain a B average or better qualify for savings. Students 22 or under who are away at school over 100 miles away and without a vehicle also qualify for a discount.

- Homeowner: You can get a discount if you’re a homeowner, even if your home insurance policy is not through Progressive.

- Sign online: Get a small discount just for getting a quote and signing your policy documents online.

- Payment: Setting up automatic payments, paperless billing, and paying in full can get you a discount.

- Continuous insurance: You can get a discount on your first policy renewal based on how long you’ve been continuously insured, even with another insurer.

The Bottom Line: Is Progressive Snapshot Worth It?

If you tend to drive carefully, it’s likely worth it to participate in Progressive Snapshot, but there are some factors to consider before you make your decision. You get a discount just for signing up, so you’ll save even before you complete the program. According to Progressive, around 80 percent of drivers earn a discount with the program, so you can expect to save even more at your policy renewal.

The program can also help you improve your driving by flagging areas for improvement and, if you use the app, providing some tips for better driving. If you use the plug-in device, you’ll get real-time alerts when it detects hard braking.

However, the state you live in should be a key factor in your decision. In certain states, Snapshot can actually lead to your rates increasing if it detects risky driving habits. The participation period also depends on your state — you may only participate for one policy period, but your driving data will be set for the remainder of your time with Progressive. This means that if your rate increases as a result of your driving report, you will likely face a higher rate at your following renewals as well (although you have the option of participating in Snapshot again to improve your score). When you sign up for a policy, it’s worth asking a representative how the discount works in your state.

Finally, phone use only impacts your score in some states. Since incorrect and oversensitive phone use tracking is one of the main complaints from Snapshot users, you may have a better experience if you live in a state where it can’t affect your rate.

Be sure to check with your agent about how the program works in your state before enrolling.

In summary:

Snapshot Is Best For You If You:

- Tend to drive safely — specifically, you avoid hard braking, rapid acceleration and phone use while driving

- Want to maximize discounts on your policy

- Live in a state where Progressive won’t raise your premium regardless of your driving data

- Are looking for ways to lower your premium after a rate increase following an accident or driving violation

Snapshot Is Not Best for You If You:

- Tend to engage in risky driving behavior

- Don’t want Progressive to track your data

- Live in California

Why You Can Trust Our Reviews

We use the following methodology to evaluate usage-based insurance discount programs like Progressive Snapshot.

Tracked Behaviors and Data

We assess what data the program uses to determine discounts. Usually, programs track braking, acceleration, speed, cornering, miles driven, phone use while driving and the time of day you’re driving. We give preference to programs that automatically detect trips. Crash detection (sometimes called accident assistance) is a nice extra feature, but we don’t consider it a necessity. Ideally, the insurance company encrypts this data and doesn’t share it with third parties for marketing purposes.

Availability

Not all programs and discounts are available in all states, so we consider where the program is available, as well as whether the discount varies by location and by how much.

Telematics Technology

Programs usually operate through a mobile app, a plug-in or Bluetooth device, or a combination of the two. While mobile apps are more straightforward than plug-in devices, they may drain your phone battery and are more likely to accidentally track trips where you’re a passenger. Plug-in or Bluetooth devices can be more precise. If the program uses an app, we check its ratings on Google Play and the Apple App Stores.

>> Learn More: Data Privacy and Drive-Tracking Apps

Rates

We prefer programs that offer potential insurance discounts of up to 30 percent or higher, plus discounts just for signing up. Another key feature we consider is whether the program could increase your premium instead of reducing it — we prioritize programs that won’t do this, regardless of driving data.

Snapshot Frequently Asked Questions

Progressive Snapshot senses whether you’re the driver or the passenger, but users report that it’s not always accurate. If it incorrectly tracks a trip, you can go into the app and modify it.

If you don’t use Progressive Snapshot, you’ll simply pay the base premium you were quoted. You won’t have the opportunity to lower your rate through this program, but you also won’t run the risk of your rate increasing. You can choose whether or not to participate in Progressive Snapshot.

To participate in Progressive Snapshot, you need to drive for at least one policy period, which is either six or 12 months. In certain states, you will only participate once, and your driving data will be set after the first policy period, while in other states, you’ll use Snapshot on an ongoing basis.

No, Progressive Snapshot does not track your speed when it comes to calculating your driving score. However, it does track rapid acceleration and braking.

Save big with Progressive.

Save hundreds of dollars when you drive safely with Snapshot.Progressive Snapshot senses whether you’re the driver or the passenger, but users report that it’s not always accurate. If it incorrectly tracks a trip, you can go into the app and modify it.

Citations

Distracted Driving. National Highway Traffic Safety Administration (NHTSA). (2024).

https://www.nhtsa.gov/risky-driving/distracted-drivingSnapshot Privacy Statement. Progressive. (2024).

https://www.progressive.com/support/legal/snapshot-privacy-statement/Trust Emerges as Top Driver of Customer Satisfaction with Auto Insurance as Prices Continue to Surge, J.D. Power Finds. J.D. Power. (2024, Jun 5).

https://www.jdpower.com/business/press-releases/2024-us-auto-insurance-studySnapshot: Drive safe and save. Progressive. (2024).

https://www.progressive.com/auto/discounts/snapshot/