How Much Is a Wrecked Car Worth?

In some cases, you may be able to make money from a wrecked car.

Get quotes from providers in your area

A wrecked car might seem like a hunk of junk—however, in some cases, you may be able to sell it for salvage parts.

A salvage vehicle is also known as a totaled car, but each state has its own threshold for what qualifies as a total loss. In many cases, a vehicle is a total loss when the cost to repair it exceeds its market value.

If your car meets the threshold, what should you do with your salvage vehicle? Is it worth selling, or should you send it to the junkyard?

Editor’s note: We have updated this guide with additional information regarding salvage vehicles and insurance department contact information by state.

What is the Salvage Value of My Car?

The value of a wrecked car is known as its salvage value — or the estimated worth of your car after a serious accident or when it’s declared a total loss. It’s the amount your damaged car would sell for at a salvage auction or to a parts buyer. Even wrecked cars have value — in usable parts, scrap metal, or repairable potential.

Typically, salvage value is about 20 to 40 percent of the car’s pre-accident market value (for example, its Kelley Blue Book value), but the exact amount depends on factors like:

- Vehicle age and mileage

- Severity of the damage

- Demand for parts from your vehicle’s make and model

- Current scrap metal prices

- Local salvage market conditions

Insurance companies often calculate salvage value when deciding whether to total a vehicle. If repair costs are close to or higher than the car’s value, they’ll usually pay you the actual cash value (ACV) minus the salvage value if you decide to keep the car.

How Do I Determine the Salvage Value of My Car?

You can estimate your car’s salvage value by:

- Looking up its current market value (through Kelley Blue Book, Edmunds, or NADA Guides) and calculating 20 to 40 percent of the value, depending on the damage

- Getting quotes from local junkyards or salvage yards

- Using online salvage value calculators

TIP:

If you sell your wrecked car to a salvage yard yourself instead of through insurance, you might get a better price — but you’ll have to handle the paperwork.

Salvage Value vs. Actual Cash Value

Actual Cash Value (ACV) is the fair market value of your car right before it was wrecked — what it was worth if you sold it in good, drivable condition. Salvage value, on the other hand, is what your car is worth after the damage, usually for parts or scrap.

Key differences:

| ACV vs. Salvage | Actual Cash Value (ACV) | Salvage Value |

|---|---|---|

| Definition | Pre-accident value of the vehicle | Post-accident value for salvage/scrap |

| Condition | Good, operable condition | Damaged or totaled condition |

| How it’s used | Insurance payouts (what you’re paid if your car is totaled) | What the insurer can recover by selling the wreck |

| Typical percentage | 100% of resale value | 20%-40% of resale value |

For example, if your car’s ACV was $10,000 before the accident, and the salvage value is 30%, then the salvage value is about $3,000.

IMPORTANT:

If you keep your wrecked car after a total loss payout, the insurance company typically subtracts the salvage value from your settlement check.

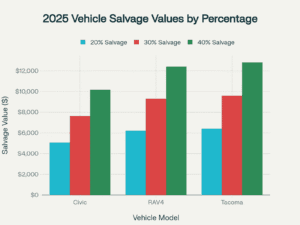

Sample salvage value payouts for three common vehicles at different percentages of pre-accident value (2025 data)

Wholesale Value vs. Market Value

Wholesale value and market value are terms that also come up when you’re trying to understand how much your wrecked car is worth:

- Wholesale Value: What dealers would pay to buy your car at auction or trade-in — lower than what a private buyer would pay.

- Market Value: What your car would sell for between private parties in the open market

Key points:

| Wholesale vs. Market | Wholesale Value | Market Value |

|---|---|---|

| Definition | Dealer trade-in or auction value | Private party sale value |

| Price level | Lower (dealer needs to resell for profit) | Higher (true buyer-to-buyer price) |

| Who uses it | Dealers, auction houses | Private buyers, insurance companies (for ACV) |

| How it impacts you | Impacts trade-in offers | Impacts insurance settlement amounts |

IMPORTANT:

Insurance companies usually base your ACV on market value, not wholesale value — but they could try to lowball by referencing wholesale data, so it’s good to know the difference.

What Is a Salvage Vehicle?

A salvage vehicle is a vehicle that has been totaled, meaning its estimated repair costs are higher than its ACV.

When Is a Car Totaled?

A car is totaled when any of the following situations occur:

- The vehicle cannot be repaired safely.

- The repairs cost more than the vehicle’s ACV.

- The damage meets your state’s total loss threshold, which you can find below.

| States | Car total loss threshold |

|---|---|

| Alaska, Arizona, California, Connecticut, Delaware, Georgia, Hawaii, Idaho, Illinois, Maine, Massachusetts, Mississippi, Montana, New Jersey, New Mexico, Ohio, Pennsylvania, Rhode Island, South Dakota, Utah, Vermont, Washington | Total loss formula (salvage value is less than cost of repair) |

| Colorado, Texas | 100% |

| Florida, Missouri, Oregon | 80% |

| Alabama, District of Columbia, Kansas, Kentucky, Louisiana, Maryland, Michigan, Nebraska, New Hampshire, New York, North Carolina, North Dakota, South Carolina, Tennessee, Virginia, West Virginia, Wyoming | 75% |

| Arkansas, Indiana, Iowa, Minnesota, Wisconsin | 70% |

| 65% | |

| Oklahoma | 60% |

Keep in mind that thresholds can change, and insurance companies may have their own policies for determining total loss within the bounds of state regulations.

How a Car Becomes a Salvage Title Vehicle

A car becomes a salvage vehicle when an adjuster inspects it and determines that it meets a state’s total loss guidelines. In that case, the car insurance company determines that the state should issue a salvage title, meaning it’s not repairable.

Common causes of total loss include:

- Head-on collisions

- Rollover accidents

- Severe weather events, like tornados, hurricanes, and flooding

- Side collisions

- T-bone crashes

- Hitting an object

Common Issues With Salvage Cars

Declaring a car to be a total loss means the vehicle has serious damage, such as:

- Blown engine

- Body damage

- Broken or bad brakes

- Broken transmission

- Dead battery

- Faulty electrical systems

- Fuel system issues

- Issues with safety features such as airbags

- Significant frame damage, like doors and windows not shutting properly

Insuring Salvage Vehicles

Can you insure a salvage vehicle? The short answer is no. To insure a damaged car, it must be sufficiently repaired by a licensed repair specialist and pass inspection.1 It could then receive a rebuilt title, but not all insurers will insure a rebuilt title vehicle and those that do may charge more.

How Car Insurance Companies Pay Property Damage Claims

Typically, insurance companies pay property damage claims by reimbursing you for the costs of the required repairs, either through a check or a direct deposit. Alternatively, your insurer may pay the repair shop directly, especially if the shop is part of the insurer’s network (also known as a direct repair program).

How Much to Expect From an Insurance Settlement

If your vehicle is declared a total loss, the insurer generally pays the actual cash value (ACV) of the car, minus any applicable deductible. This assumes you hold collision and comprehensive coverage. For financed or leased vehicles, the payment often goes directly to the lender to settle the remaining loan balance, with any surplus sent to you.

Some insurers offer new or better car replacement coverage. If you have opted for that add-on, your insurance company will pay to replace your car with a new or similar car of the same make and model if your car is totaled in a covered accident.

How to Fight a Total Loss Settlement

If you don’t agree with your total loss settlement and believe your car is worth more than the insurance company declared, follow these steps to fight it.

- Hire your own appraiser. To prove that your car has a higher value, you’ll need an appraiser to oversee a vehicle inspection and prepare a report. The appraiser will have a mechanic inspect the car, take photographs, and provide evidence of its worth and/or repair costs using maintenance records and other documentation of upgrades.

- Hire a lawyer and negotiate. Use the appraiser’s evidence to negotiate with your insurer or, better yet, hire a lawyer to do it for you.

- Contact your state’s department of insurance. If the negotiations aren’t successful, file a complaint with your state’s insurance commissioner using the contact information below.2

| Insurance department contact information by state | URL | Phone number | Mailing address |

|---|---|---|---|

| Alabama | http://www.aldoi.gov | 334-269-3550 | 201 Monroe Street, Suite 502

Montgomery, Alabama 36104 |

| Alaska | https://www.commerce.alaska.gov/web/ins/ | 907-269-7900 | 550 West 7th Avenue, Suite 1560

Anchorage, Alaska 99501-3567 |

| Arizona | https://difi.az.gov/insurance | 602-364-3100 | 100 N. 15th Avenue, Suite 261

Phoenix, Arizona 85007-2630 |

| Arkansas | https://insurance.arkansas.gov/ | 501-371-2600 | 1 Commerce Way

Little Rock, Arkansas 72202 |

| California | http://www.insurance.ca.gov | 800-927-4357 | 300 South Spring Street, 14th Floor

Los Angeles, California 90013 |

| Colorado | https://doi.colorado.gov/ | 303-894-7499 | 1560 Broadway, Suite 850

Denver, Colorado 80202 |

| Connecticut | https://portal.ct.gov/cid | 860-297-3800 | 153 Market Street, 7th Floor

Hartford, Connecticut 06103 |

| Delaware | https://insurance.delaware.gov/ | 302-674-7300 | 1351 West North Street, Suite 101

Dover, Delaware 19904 |

| District of Columbia | http://www.disb.dc.gov | 202-727-8000 | 1050 First Street NE, 801

Washington, D.C 20002 |

| Florida | http://www.floir.com | 850-413-3140 | The Larsen Building, 200 East Gaines Street

Room 101A Tallahassee, Florida 32399-0301 |

| Georgia | https://oci.georgia.gov/ | 404-656-2070 | 2 Martin Luther King Jr. Dr. West Tower, Suite 702

Atlanta, Georgia 30334 |

| Hawaii | http://cca.hawaii.gov/ins/ | 808-586-2790 | P.O. Box 3614

Honolulu, Hawaii 96811 |

| Idaho | http://www.doi.idaho.gov/ | 208-334-4250 | 700 West State Street, 3rd Floor

Boise, Idaho 83720-0043 |

| Illinois | https://insurance.illinois.gov/ | 217-782-4515 | 320 West Washington Street

Springfield, Illinois 62767-0001 |

| Indiana | http://www.in.gov/idoi | 317-232-2385 | 311 West Washington Street, Suite 300

Indianapolis, Indiana 46204-2787 |

| Iowa | https://iid.iowa.gov/ | 515-654-6600 | 1963 Bell Avenue, Suite 100

Des Moines, Iowa 50315 |

| Kansas | https://insurance.kansas.gov/ | 785-296-3071 | 1300 SW Arrowhead Road

Topeka, Kansas 66604-4073 |

| Kentucky | https://insurance.ky.gov | 502-564-3630 | 500 Mero Street 2 SE 11

Frankfort, Kentucky 40601 |

| Louisiana | http://www.ldi.la.gov | 225-342-5423 | 1702 North Third Street

Baton Rouge, Louisiana 70802 |

| Maine | https://www.maine.gov/pfr/insurance/ | 207-624-8475 | 34 State House Station

Augusta, Maine 04333-0034 |

| Maryland | https://insurance.maryland.gov/ | 410-468-2090 | 200 St. Paul Place, Suite 2700

Baltimore, Maryland 21202 |

| Massachusetts | https://www.mass.gov/orgs/division-of-insurance | 617-521-7794 | 1000 Washington Street, Suite 810

Boston, Massachusetts 02118 |

| Michigan | https://www.michigan.gov/difs/ | 517-284-8800 | 530 West Allegan Street

Lansing, Michigan 48933 |

| Minnesota | https://mn.gov/commerce/industries/insurance/ | 651-539-1500 | 85 7th Place East, Suite 500

St. Paul, Minnesota 55101 |

| Mississippi | http://www.mid.state.ms.us | 601-359-3569 | 1001 Woolfolk State Office Building, 501 North West Street

Jackson, Mississippi 39201 |

| Missouri | https://insurance.mo.gov/ | 573-751-4126 | 301 West High Street, P.O. Box 690

Jefferson City, Missouri 65102-0690 |

| Montana | https://csimt.gov/ | 406-444-2040 | 840 Helena Avenue, Suite 270

Helena, Montana 59601 |

| Nebraska | https://doi.nebraska.gov/ | 402-471-2201 | 1526 K St Suite 200

Lincoln, NE 68508 |

| Nevada | https://doi.nv.gov/ | 775-687-0700 | 1818 East College Parkway,

Suite 103 Carson City, Nevada 89706 |

| New Hampshire | https://www.nh.gov/insurance/ | 603-271-2261 | 21 South Fruit Street, Suite 14

Concord, New Hampshire 03301-7317 |

| New Jersey | https://www.state.nj.us/dobi/aboutdobi.htm | 609-292-7272 | 20 West State Street

Trenton, New Jersey 08625 |

| New Mexico | https://www.osi.state.nm.us/ | 855-427-5674 | 1120 Paseo de Peralta, Suite 428

Santa Fe, New Mexico 87501 |

| New York | https://www.dfs.ny.gov/ | 212-480-6400 | 1 State Street

New York, NY 10004 |

| North Carolina | https://www.ncdoi.gov/ | 855-408-1212 | 1201 Mail Service Center

Raleigh, North Carolina 27699-1201 |

| North Dakota | https://www.insurance.nd.gov/ | 701-328-2440 | State Capitol, 600 East Boulevard, Dept. 401, 5th Floor

Bismarck, North Dakota 58505-0320 |

| Ohio | https://insurance.ohio.gov | 614-644-2658 | 50 West Town Street, Third Floor, Suite 300

Columbus, Ohio 43215-1067 |

| Oklahoma | https://www.oid.ok.gov/ | 405-521-2828 | 400 NE 50th Street

Oklahoma City, Oklahoma 73105 |

| Oregon | https://dfr.oregon.gov/Pages/index.aspx | 503-378-4140 | 350 Winter St., NE Room 410

Salem, Oregon 97309 |

| Pennsylvania | https://www.insurance.pa.gov/Pages/default.aspx | 717-787-7000 | 1326 Strawberry Square

Harrisburg, Pennsylvania 17120 |

| Rhode Island | https://dbr.ri.gov/insurance-banking-securities-and-charitable-organizations/insurance | 401-462-9500 | 1511 Pontiac Avenue

Cranston, Rhode Island 02920 |

| South Carolina | https://doi.sc.gov/ | 803-737-6160 | 1201 Main Street, Suite 1000

Columbia, South Carolina 29201 |

| South Dakota | https://dor.sd.gov/ | 605-733-3311 | 445 East Capitol Avenue

Pierre, SD 57501-3185 |

| Tennessee | https://www.tn.gov/commerce/insurance-division.html | 615-741-2241 | 500 James Robertson Parkway, Suite 660

Nashville, Tennessee 37243-0565 |

| Texas | https://www.tdi.texas.gov/ | 512-676-6000 | 1601 Congress Avenue

Austin, Texas 78701 |

| Utah | https://insurance.utah.gov/ | 801-957-9200 | 4315 S. 2700 W., Suite 2300

Taylorsville, Utah 84114-6901 |

| Vermont | https://dfr.vermont.gov/industry/insurance | 802-828-3302 | 89 Main Street, Drawer 20

Montpelier, Vermont 05620-3101 |

| Virginia | https://www.scc.virginia.gov/ | 804-371-9741 | 1300 E. Main Street, Tyler Building

Richmond, Virginia 23219 |

| Washington | http://www.insurance.wa.gov | 360-725-7100 | 302 Sid Snyder Ave., SW, Suite 200

Olympia, WA 98501 |

| West Virginia | http://www.wvinsurance.gov | 304-558-3386 | West Virginia Lottery Building, 900 Pennsylvania Avenue

Charleston, West Virginia 25302 |

| Wisconsin | https://oci.wi.gov/Pages/Homepage.aspx | 608-266-3585 | 101 E. Wilson St. Madison, WI 53703 |

| Wyoming | https://doi.wyo.gov/ | 307-777-7401 | Herschler Building, 106 East 6th Avenue

Cheyenne, Wyoming 82002 |

What to Do If Your Car Is Totaled

All hope is not lost if your car is totaled. In some cases, you may be able to make money from it.

Should You Repair or Sell Your Salvage Vehicle?

If you believe your car’s salvage value is greater than the settlement offer you received, you may be able to make money by repairing and selling the vehicle. However, if the settlement offer was fair, it’s best to accept it and move on.

Selling Your Salvage Car for Cash

Another option is to sell your salvage vehicle as is through third parties like Cash for Cars, Car Brain, Copart Direct, and Salvage Reseller. You can also sell it yourself as a private seller using Craigslist or Facebook Marketplace, although this will take more time and effort on your part. A third route is to sell it to a scrapyard directly. For compensation, you’ll receive the resale value, or what you sold your salvage vehicle for.

FYI:

Some charities, like Goodwill and Habitat for Humanity, let you donate your salvage vehicle for a tax deduction and will even tow it for free.

If your goal is to make the most money from your salvage vehicle, get quotes from multiple car-buying companies and look for those without hidden fees and that will tow your car for free.

Where Do Totaled Cars End Up?

If they don’t end up in salvage yards, totaled cars can be driven outside of the U.S., where owning and insuring salvage vehicles is easier. However, in states that let people repair and insure salvage vehicles, they may be driven in the U.S. as well.

Conclusion

Car ownership is one of the largest expenses most people face after housing, so it’s no surprise that dealing with a totaled car can feel overwhelming. However, with the right insurance coverage—like collision, comprehensive, or new/better car replacement—you can recover your car’s actual value and lessen out-of-pocket expenses. Beyond insurance, you’ve got other options, too. You might donate it for a tax deduction or sell it to a buyer or scrapyard.

Choosing the best option depends on your situation. If you’re considering a non-insurance route, be prepared to invest more time, effort, research, and money up front. For example, while repairing and reselling your car is a possibility, it will require hiring a licensed repair specialist, passing inspections, and spending money upfront. In many cases, this route may not be worth the effort, especially if your insurance company offers you a fair settlement. Taking the time to explore your options will help you make the most of this challenging situation.

Learn more about how auto insurance claims work and how long an insurance claim takes to process.

Frequently Asked Questions

Whether it’s OK to buy a wrecked car depends on what you want to do with it. You cannot drive or insure a wrecked car legally. However, if you plan to sell it for parts or repair it, that is OK.

A wreck usually reduces a car’s value by 20 to 40 percent of its pre-accident market value, depending on the severity of damage, vehicle age, mileage, and demand for its parts. While minor damage may have less impact, significant accidents and salvage titles can cause greater depreciation.

When a car is declared totaled, insurance typically pays the vehicle’s actual cash value (ACV) before the accident, minus any applicable deductible and the salvage value if you keep the car. This amount is often determined by industry guides like Kelley Blue Book and generally reflects what your car would sell for in good, used condition.

To get an estimate on a wrecked car, check its current market value in guides like Kelley Blue Book, Edmunds, or NADA, and calculate 20 to 40 percent depending on the level of damage. You can also get quotes directly from junkyards, salvage yards, or use online salvage value calculators for a quick estimate.

Citations

Can you get insurance on a salvage title car? Progressive. (2023).

https://www.progressive.com/answers/insurance-salvage-title-car/Industry Directory. Insurance Information Institute. (2024).

https://www.iii.org/services/directory/company-categories/state-insurance-departments